Even that India is trying to counter its growing dependence on Russian crudes and petroleum products, the country’s Russian import volumes have again increased. Official market data shows that the share of Russian oil in India’s imports has increase to around 40% in H1 FY2023-2024. The latter means that Moscow has been able to consolidate its leading position in the top suppliers list of India. Main underlying reasons seems to be that Indian refiners have cut buying Middle Eastern crudes. At the same time, India also is the leader in the list of current Russian oil importers worldwide, mainly due to still existing and commercially attractive Russian discounts. Analysts expect that the position of Russia in India even will grow, as most Middle East suppliers are keeping to their overall OPEC export agreements, with Saudi Arabia even prolonging its existing voluntary cuts. These OPEC moves have been supporting India’s quest to diversify its overall suppliers, with Moscow leading the pack.

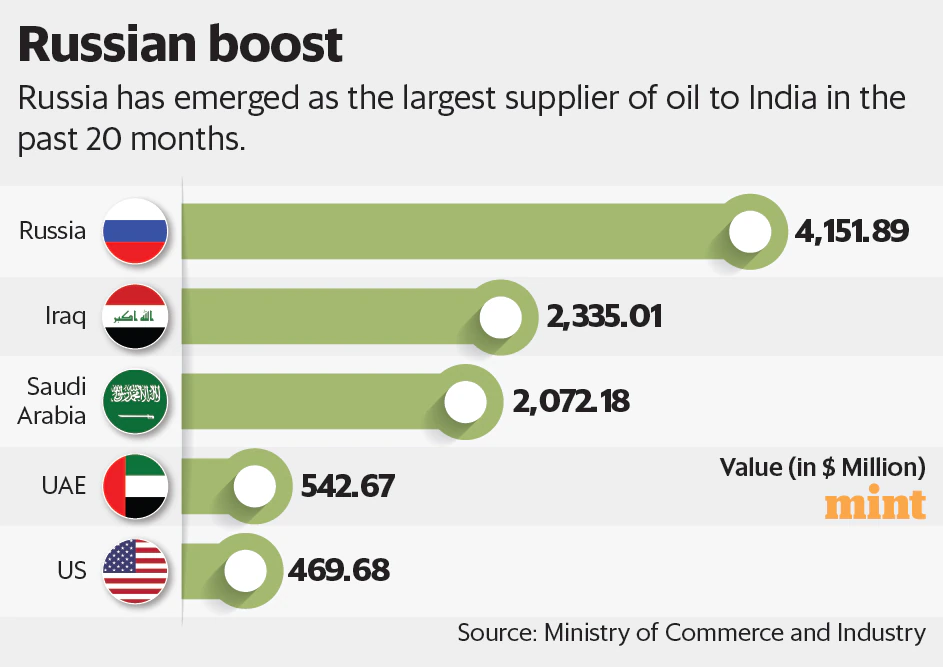

Industry data shows that the Asian giant has imported around 1.76 million bpd of Russian oil from April to September. For H1 FY2023-2024 this is more than double the about 780,000 bpd in the same year-ago period. In September, India’s Russian oil imports recovered from a slight dip in July and August, to 1.54 million bpd, up 11.8% from August and 71.7% from a year ago, the data showed. Behind Russia, Iraq and Saudi Arabia are the main suppliers to India. These two however have been hit by lower levels, as imports from Iraq fell by 12% and Saudi Arabia by 23%, respectively to 928,000 bpd and 607,500 bpd. Overall imports from the Middle East declined by 28% to 1.97 million bpd in the period April-September.

Overall Russian oil exports are on the rise again, in contrast to the existing agreement between OPEC’s kingpin Saudi Arabia and Russia to limit production. Last week (Oct 15), data emerged that overall Russia’s seaborne crude exports hit a three month highest level, as in the last week around 3.51 million barrels were shipped from Russian ports. The latter compares to an increase of 285,000 bpd in comparison to the week before. Main export increases were due to shipments in the Black Sea area, reaching a six-week high.

Importers such as India, China and even Middle East will however be looking very careful at the new sanctions and regulations posed on vessels carrying Russian crude. Sources in the market are indicating that oil freight rates from Russia’s Baltic ports to India are up some 50% the last week. The main reason is that shipowners are leaving this dark market in fear of new US sanctions . As a substantial part of these dark ship owners are Europeans, US sanctions and a more stricter implementation could be causing financial pain. At present, freight rates to India from Russia are reported to hit levels of $7.5 million per voyage, up exponentially from the $4.5 million-4.8 million a week before. Higher costs will be biting either in the profits made by Russia or will cut part of the discounts for importers.

The last days another possible major financial constraint is emerging in Russian oil. The push by Moscow, as also by Beijing, to try to remove the US dollar from the commodity markets is being hit severely as importers start to be negative of payment in Ruble or Yuan. Indian sources are indicating that New Delhi’s government is starting to be uncomfortable to pay Russian crudes in Chinese yuan. News agency Reuters has reported that settling trade in yuan is more costly, as India needs to convert rupees into Hong Kong dollars and then yuan. Sources have stated that Indian payments have been postponed already on several crude deliveries. It seems that Indian refineries are trying to find yuan alternatives at present. The Indian sector has also been using UAE dirham for payments, which is less costly in trading. Geopolitically, India also is not very eager to boost the Chinese currency position on global financial markets, as there is still a major power struggle ongoing between China and India. Not only economic growth strategies collide, as China and India have major border disputes still raging, costing on a regular basis life of soldiers. Moscow until now has been very negative about using the possibility of an Indian Rupee as currency for trade.