In stark contrast to the average opinion about the negative fall-out of instability or conflicts, Israel’s latest bid round shows that global energy interests are too high to be constrained by all.

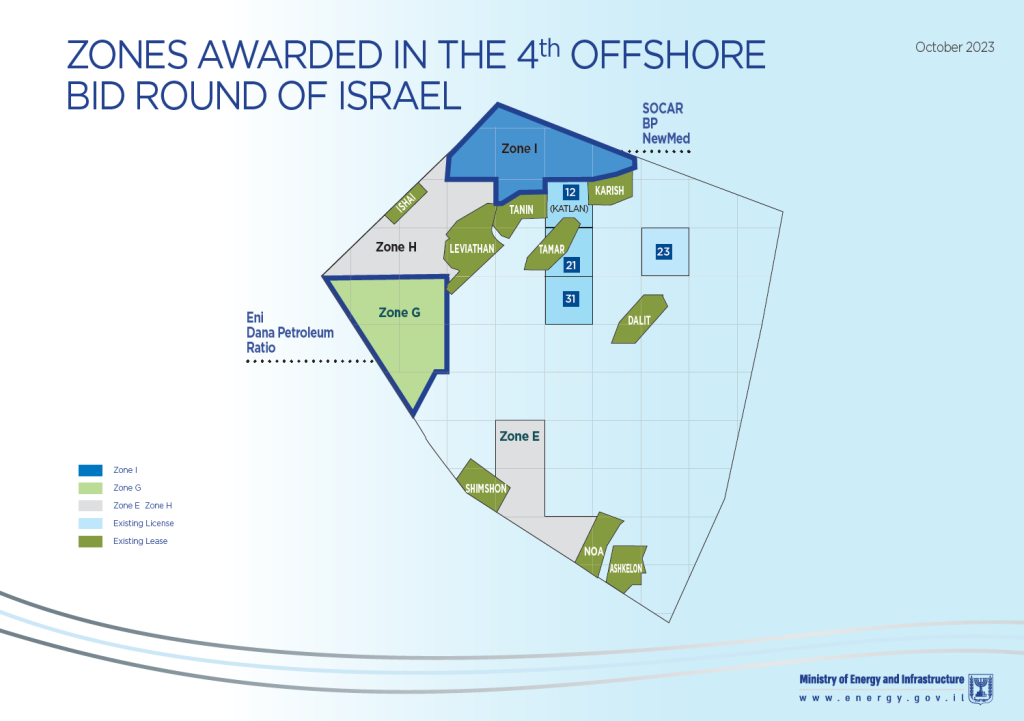

On October 30 Israel’s ministry of energy and infrastructure has awarded 12 exploration tenders, with in total 6 companies involved, of which 4 are new to Israel’s offshore projects. According to the Israelis, the tenders for the I region have been awarded to a consortium of Delek Group’s unit NewMed Energy, BP (British Petroleum) and SOCAR (State Oil Company of Azerbaijan Republic). On the latter concession SOCAR will be the operator. The I region is west of Energean’s Karish oil field. A consortium made up of Ratio Energies, Dana Petroleum (which works in the North Sea with Delek unit Ithaca) and Italian oil major Eni has one region G, in which Eni will be the operator. The G region is southwest of the Leviathan field. In a statement given by the ministry of energy, it was stated that “if natural gas is found in the new licenses, this will lead to diversification of supply and the strengthening of competition in the Israeli economy.” The Israeli government will receive around $15 million as a signing on grant. The success of Israel’s offshore gas reserves concessions has already been clear, but now all attention is on the question of whom will be awarded the other two blocks. At present, bidders include Energean and Aharon Frankel, the biggest shareholder in Tamar Petroleum, which submitted bids as part of separate consortia. Sources informed Israeli financial newspaper “Globes” that no date has yet been set for discussions on the two other blocks. The companies will explore two areas next to Israel’s Leviathan field, the country’s largest and one of the world’s biggest deep-water gas discoveries.

Overall the awards are of high importance, especially looking at the growing instability in and around Israel at present. The fact that no international operators until now have refused the awards, and the fact that major new parties, such as BP, ENI and SOCAR, are entering Israel’s offshore future, can be seen as strong commitment and interest.

At the same time, eyes are also on the ongoing discussion between BP-Abu Dhabi National Oil Company (ADNOC) and NewMed Energy, as the two majors are looking to acquire a 50% stake in the Israeli entity. The last days it has become clear that the NewMed owners want a higher price from the majors, but the impact of the Hamas war is causing a major setback. At present, the shares of NewMed have lost almost 25%, causing growing fears that the total deal could fall through.

Concerns are also still there about the overall security of all the offshore projects, as Hamas, Hezbollah and others could be targeting them in the coming days or weeks. Israel has already shutdown the Tamar offshore gas field, the country’s second-largest. The project is owned by US oil and gas major Chevron, Dor Gas Exploration Limited Partnership, Everest Infrastructures, Isramco Negev 2, UAE-based Mubadala Investment and the Israeli company Tamar Petroleum. Before the shutdown, the field typically met around 70% of Israel’s power generation needs.