By Cyril Widdershoven

As commodity traders have woken up from hibernation, as their algorithms are not functional in a more volatile geopolitical military crisis situation, all eyes are now focused on the USA and its allies. Some however start to understand that the current Red Sea maritime threat is not only going to hit conventional maritime trade such as crude oil, petroleum products, LNG or container shipping, but geopolitical power projections are also being hit. The ‘unexpected’ Houthi escalation in and around the Bab El Mandab, threatening to bring down maritime transport in and around the Red Sea arena, nothing new and should have been dealt with before the current escalation. The last years, major reports have been written about the ongoing geopolitical regional and global power projections in the area, with a main focus on the Horn of Africa, Sudan or Yemen, but no real action has been taken. Western and Arab powers have shown their maritime muscles but real action to quell or remove the existing military or terrorist threat has not been implemented. Showing force doesn’t mean a thing if actions by 3rd parties, such as Houthis or Iran, are not being met by real kinetic action if needed.

Without any doubt military action will be put in place the coming days or weeks, but harm already has been done. Without real exchange of kinetic force, Iran and its allies have shown that they are able not only to disrupt vital maritime waterways, outside of the Iranian claimed influence sphere in the Persian/Arabian Gulf, but also have made it clear that their own regional and military assessments are not always aligned with their global power backers, Russia and China. The Houthi operations, which are directly linked to Iran, have a very detrimental effect on Russia’s current strategies to monetize its oil and gas reserves. Moscow now is looking at a major ally threatening one of the only financial lifelines available to the Putin regime.

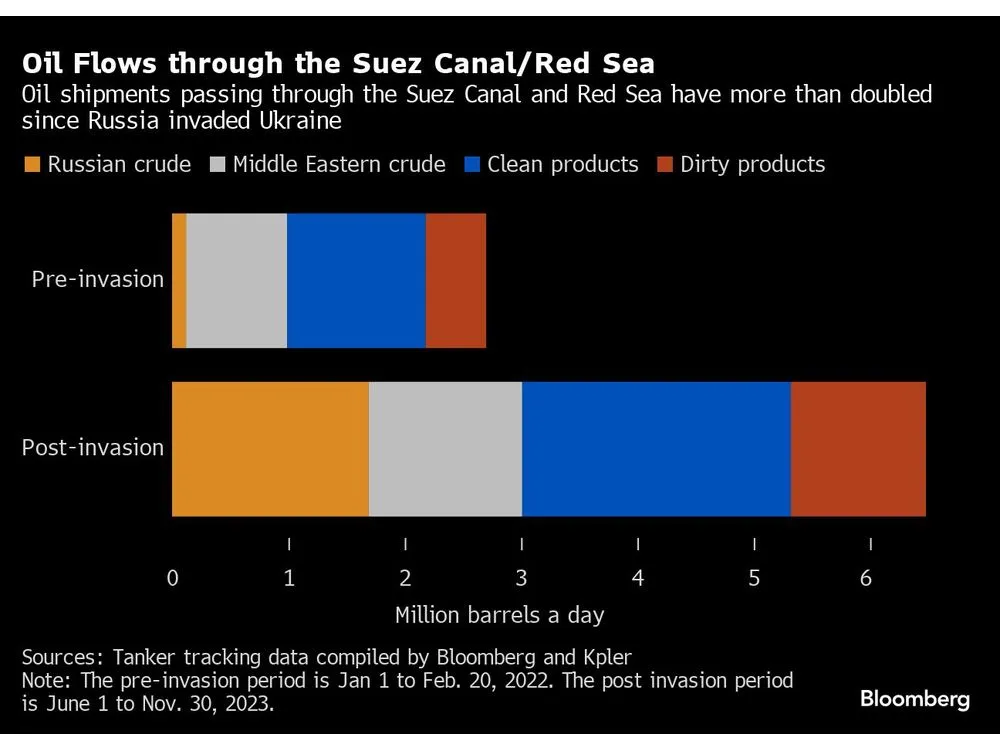

Moscow’s oil and gas exports, which have been constrained by Western sanctions after Russia’s invasion of Ukraine, are directly linked or largely depending on access to maritime trade routes to China, India and Arab Gulf countries. Since 2022 Putin’s cronies have increasingly relied on cargoes going to Asia or the Middle East. Overall Russian crude oil volumes transported via the Red Sea (both northbound and southbound) have led to volume increases of around 140%, reaching levels of 3.8 million bpd.

Military analysts are keeping an eye on the developments, not only to assess the threats made by Houthis, or its Iranian backers, which already have directly threatened a potential reaction if Western forces will hit Houthis, but also the potential moves being made by Russia and even China. The latter is very quiet at present, while most China’s trade to Europe is being threatened. For Russia, the assessments are much more difficult. While the Houthi-Iran alliance is currently causing havoc for Moscow’s energy exports via the Red Sea, Putin’s regime needs them as pawns in the battle with the West. Until now, Moscow hardliners have been rather happy with the 2nd and 3rd front options in the Middle East. The Western focus on the Israel-Hamas/Hezbollah/Iran confrontation has removed part of the pressure in the Ukraine. Now, however, Putin’s snakes are biting their own tail it seems. A normal Russian reaction would be very swift and bloody, but hitting its own allies is one option that is not on the table for Moscow at present. China also is put in a corner, as confronting the Houthis in Yemen would bring it in direct conflict with Iran’s IRGC hardliners.

The potential blockade of the Red Sea has already caused worldwide concerns about oil supply disruptions, and the potential of much lower Russian volumes being available on the market. The latter situation comes at the same time that OPEC+ is set to keep to its prolonged production cuts into 2024, which Russia is supporting. Moscow stated last week that it will be cutting another 50,000 bpd. The last couple of days, the Red Sea threats are already showing in higher futures overall. Analysts agree that the increased geopolitical risk premium, due to the Houthi operations, is part of the crude oil price resurrection.

When taking a look at specific effects on oil market sectors, the main focus should be on diesel. Already northwest European diesel refining margins have increased substantially, as tankers movements are constrained in the Red Sea, while oil prices also are up. These effects will be even much higher if other oils are following British oil and gas major BP’s move to pause all its Red Sea transits. Already, oil tanker giant Frontline also has stated that its vessels will not be passing the Red Sea. For all maritime trade the only other route is around the Cape, which is adding up to three weeks of travel to all, putting deliveries to refineries at risk, while disrupting shipping schedules.

European traders are looking at present mainly at gasoil and diesel. For gasoil stocks the situation is still healthy, as indicated by parties in the ARA (Amsterdam-Rotterdam-Antwerp) refining and storage region. Diesel stocks have also increased the last weeks, but a full-scale stop to movements via the Red Sea will have strong effect.

The list of companies rerouting their vessels is growing 24/7, including Maersk, MSC, Hapag-Lloyd, CMA CGM, Zim, Evergreen, Yang Ming, Cosco, OOCL and ONE. At the same time oil and gas related companies already include Frontline, Euronav, BP and Equinor. Argus has also reported that three liquefied natural gas (LNG) carriers and three very large gas carriers (VLGCs) diverted from the Red Sea route on Monday.

Some analysts are looking at a potential reprieve coming from a new U.S.-led multinational military effort to protect commercial shipping from Houthi attacks, called Operation Prosperity Guardian. The main issue however is will shippers be comfortable to transit the Red Sea in a convoy, at a lower speed, but protected by military and navy assets? Looking at costs and time, these options are however commercially attractive than to sail around Africa.

Overall, based on data provided by maritime consultancy and advisory company Clarksons Research, 21% of global container shipping moves transit the Suez, with the share at 12% for refined product moves, 11% for LNG, 8% for liquefied petroleum gas (LPG), 8% for crude and 5% for dry bulk. For crude tankers in the Suezmax size category (1 million-barrel capacity) or smaller, the share jumps to 20%.

As always, there is a win-win situation in any crisis. Analysts expect that tanker stocks have a much higher upside than container stocks the coming months (or even years). The latter assessment is based on the projected growth of container shipping capacity of 8% in 2024 (new build), while overall container trade is expected to be between 3-4%. Some upside is presently caused by the expected Cape delays in travel, making demand overall stronger. Current tanker rates however could show a high upside, if the Red Sea issue continues for longer, as the market is already very tight. One analyst even indicated that Suezmax rates could hit $200,000 per day, in comparison to current $48,800 per day.

Consultancy company Kpler warns that, based on its own assessments of the Suez Canal threats, that jet fuel is the most exposed at present. The latter is based on the fact that around 30% of total global jet fuel flows from the Middle East and India to Europe. Keep in mind, these volumes are directly linked to Russian sea-borne trade volumes too. The situation is very simple, if Russia is not able to transport its crudes or products, which are mainly Black Sea originated, to Asia and the Middle East, these parties will be affected too. Argus also has warned, but mainly for diesel. Arab Gulf diesel is key for supply in Europe. The latter is the main substitute at present for Russian diesel, which is unavailable at present for Europe. A blockade of the Red Sea – Suez Canal route will not only force diversion of these volumes, but also put another price tag on transport and products costs.