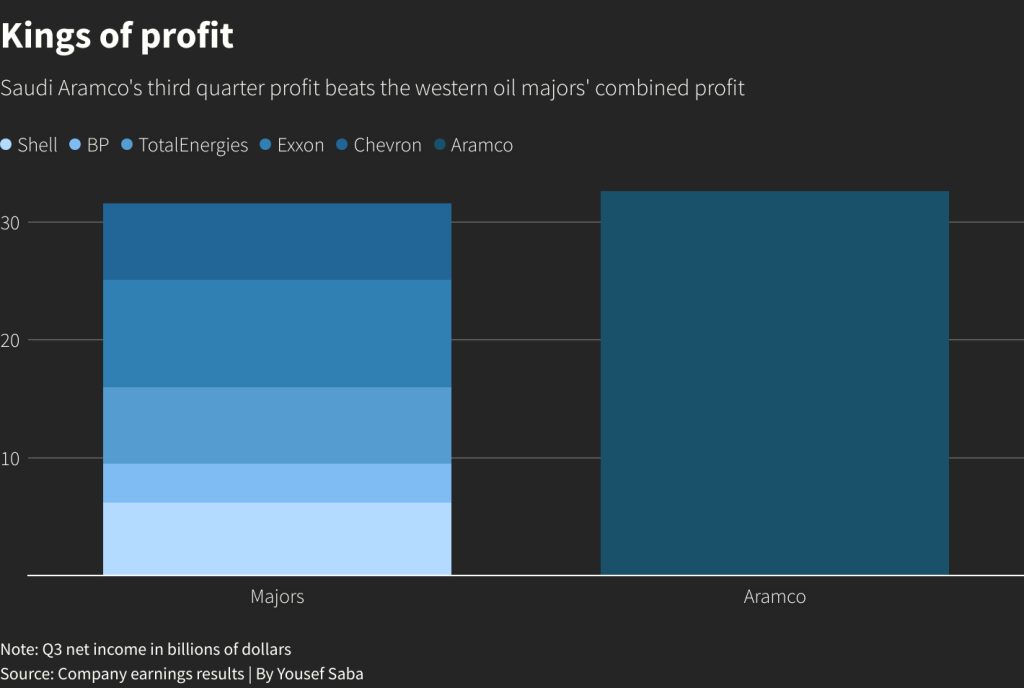

The world’s largest oil company Saudi Aramco (Aramco) has reported its Q3 2023 figures, showing a 23% fall in net profit. The main underlying reason for the decline is lower overall oil prices and volumes, mainly caused by the unilateral Saudi decision to cut an additional 1 million bpd on top of the OPEC agreement. Analysts are still relatively positive as the results have beating slightly the estimates made. In its report Aramco states that net profit has fallen to $32.6 billion for the quarter to Sept. 30, which is $0.8 billion more than expected by 12 analysts in a company-provided forecast. Aramco also reiterated that the effects of lower oil prices and volumes has been partially countered by a reduction in production royalties. The results have only slightly influenced share prices, which are still hovering around yesterday’s levels. Again it seems that Aramco has beaten the competition, as shown by the sharp decline in profits of US majors ExxonMobil and Chevron.

The market is expecting however more fireworks the coming months. At present Saudi Arabia, the de-facto owner of the NOC, stated the last days that it continues with its voluntary oil output cut of 1 million bpd, at least until the end of 2023. The Saudi decision, as it is also the main voice of OPEC, has put a bottom under oil prices the last months. When looking at the results of the NOC, overall hydrocarbon production in Q3 is set at 12.8 million barrels of oil equivalent per day. These volumes have resulted in an overall revenue of $113.09 billion, which is a decline of $31.9 billion in comparison to Q3 2022. Aramco also reports that its royalty and tax payments have shrunk from $24.3 billion last year to $14.7 billion Q3 2023.

At the same time, Aramco reports that it has declared a quarterly $19.5 billion base dividend, which is paid regardless of performance. It also has indicated that a second $9.87 billion distribution of performance-linked dividends will be paid out in the fourth quarter, based on 2022 and the first nine months of 2023. Most of these dividends are being paid into the wallet of the Saudi government, as the national oil is still the main revenue stream for the country’s budget. Even that the impact of non-oil related revenues is growing, as proponed also by the ongoing economic diversification strategy of Saudi Crown Prince Mohammed bin Salman’s Vision 2030, the Kingdom is still a hydrocarbon based rentier state optima forma. As the main shareholder of the listed-oil company, currently mainly on the Saudi exchange Tadawul, the Kingdom holds 90.19%, Saudi sovereign wealth fund Public Investment Fund (PIF) 4% and PIF subsidiary Sanabil another 4%.

Company officials have again reiterated that in contrast to growing reports published by so-called independent energy agencies, Aramco does see energy demand to increase over the mid- to long-term. The Saudi giant bluntly stated that it will continue with its “largest capital program in its history”. Aramco’s current capital expenditure in Q3 increased to $11 billion, an increase of $2 billion in comparison to Q3 2022. Analysts however have indicated that Aramco has narrowed its 2023 capex forecast to $48 billion to $52 billion from an earlier $45 billion-$55 billion range.

As always media is again speculating about a possible new stake sale by Aramco, as all agree that there is still huge appetite. Aramco’s initial IPO in 2019 raised $25.6 billion, while additional shares too the total to $29.4 billion. Crown Prince Mohammed bin Salman has already several times indicated that a new sale of shares is expected, which revenues will be handed over again to the PIF. It is rumored that a 4-5% stake could again be on offer, which is expected to hit again the jackpot. Looking at the current market developments, it can be expected that there will be an immense interest of Asian investors and funds to take part, but Western funds and financials will this time for sure take charge. Stability and dividends of Aramco are putting it to the top of the list, almost at the same level of Shell, the IOC known to be keeping its dividends at level whatever results are. Aramco’s strategy is almost a copy, keeping in mind that most money flows to the Kingdom’s government.

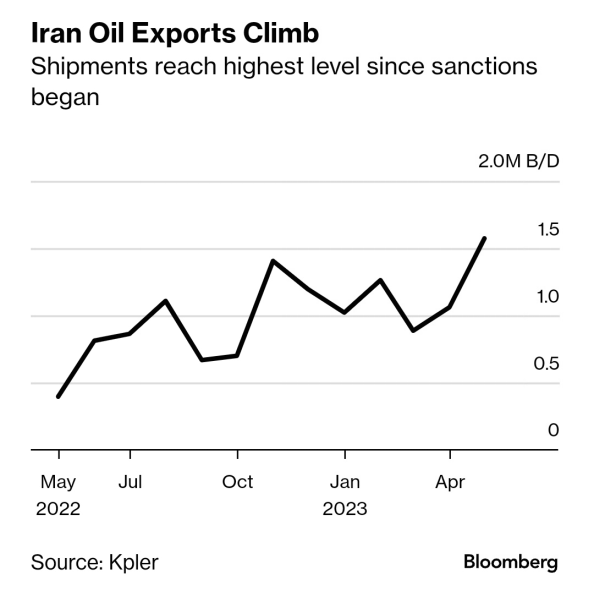

Still there are some signs of concern for the future profitability of Aramco’s current strategy. Even that the company is expanding its downstream operations in China and Asia, overall pressure on oil prices and worrying signs of a possible slowdown in demand are on the horizon. The move made by Aramco not to raise its prices for its benchmark crude grade to Asia is seen by some as possible cautious approach to deal with Asian demand overall. On November 6, Aramco said it will not change its official selling price (OSP) of its main Arab Light grade for Asian refiners for December-loading cargoes, which means it is still at a premium of $4 per barrel over Oman/Dubai average. The latter is also a sign that Aramco and Saudi Arabia are not yet worried about the potential fall-out of the Gaza war, and a possible regional conflict.

For the coming months it is however much more prudent to keep Aramco’s performance linked to the overall performance of the Saudi economy and the government budget situation. As the company’s dividends and revenues are the key factor on which the Kingdom’s cork is flowing, any decline in revenue and/or volumes has a direct effect on all. After several quarters of high GDP growth and influx of money, last figures presented are less rosy. As reported by the Saudi statistic agency the Kingdom’s gross domestic product (GDP) has shrunk by 4.5% year-on-year in Q3 2023. The latter is not worrying, but it is the largest contraction since the 2020 Covid-19 situation. Most of the decline is directly linked to lower oil revenues, slightly mitigated by higher non-oil activities (+3.6%). The statistics agency reported that Saudi’s oil sector contracted by 17.3% year-on-year in Q3, mainly due to lower production as indicated by its unilateral production cut. Analysts expect volumes to stay low until beginning of 2024. Some indicators inside of the Kingdom show however that this could be earlier than expected, as higher revenues are needed soon to prop up finances for the mainstream Giga Projects and new presented strategies such as maritime, ports and logistics. For 2023 the IMF already predicts a GDP growth of 0.8%, which is a steap decrease in comparison to the 8.7% growth in 2022.

International rating agency Standard & Poor’s (S&P) already has indicated that the only option to regain an upward momentum is to phase out production cuts in 2024. Until now, Saudi GDP growth is expected to be sluggish at 1.1% in 2024. The Saudi performance at present is not worrying but stands in contrast to its main competitor in the region, UAE. All are showing the impact of lower oil production, but the UAE still shows an impressive growth, 3.7% in H12023. The current fledgling performance of the Saudi economy is worrying the power circles in Riyadh for sure. It is just a very short period of time since the Kingdom was making headlines as the best performing economy worldwide. In 2022 Saudi Arabia’s GDP grew by almost 9%, the highest of the G20 countries. At the same time it recorded its first budget surplus in a decade. As the media reported, Saudi GDP also passed $1 trillion for the first time, a milestone to some. All these highly published facts don’t however hide the fact that the Kingdom still is a mainstream rentier state economy. Oil exports are still key, accounting for 80% of Saudi Arabia’s export revenues. Any trouble in the Kingdom’s Paradise also will be putting pressure on the whole region. The ongoing economic boom, its diversification gigantism and influx of companies to reap the rewards of the latter could be slowed down, hitting directly also other economies. Even that Riyadh is pushing international companies to set up regional HQs by January 2024 in the Kingdom, main work and money flows are still going to the others.

A struggling or even perceived struggling cash machine called Aramco will have its impact on all. If Aramco sneezes the GCC fetches a cold. If the oil giant is having troubles to make the right amount of revenues, not only to finance the Kingdom but also to keep its own production and future projects in order, a Dutch disease could be hitting very soon. This time not the well-documented Dutch version of the 1950s-1980s, but the new one…which implies lower hydrocarbon revenues and the need to increase other sources. For Riyadh this still is partly in their own hands. OPEC’s Kingpin, officially looking at market stabilization and global economic interests, is surely not going to take the brunt of all mishaps around the world. If other OPEC members are not able to produce as agreed, especially in line with the 2024 production assessments discussion, Saudi powers could decide to reverse the current production strategy, as more barrels times high prices will be more attractive than keeping the market stable. Resource nationalism and Vision 2030 could be two sides of the same coin in the end. Overall, the future of MBS and Vision 2030 is more important than the fate of some fledgling OPEC members in Africa or Latin America. As the 21st century is already the period of “Nations First”, Saudi Arabia could be jumping on the same bandwagon very soon.