The continuation of Israel’s war on Hamas, and the growing regional instability and threat of a major new conflict, are worrying China increasingly. Without any options at present to interfere in the ongoing crisis, Beijing’s only option at present seems to be to sit it all out. Still, hardliners in Beijing’s ruling circles also will be assessing their options, not only in the Middle East or Iran, but increasingly with regards to Taiwan and its bilateral cooperation with Russia. Geopolitical conflicts of this order could be a main advantage for a third party, as all eyes are on Israel, USA, Iran and Russia, leaving enough maneuver space for a military move somewhere else on the globe. The combination of the Russian onslaught on Ukraine, in which USA and NATO are involved on Kiev’s side, and the full military support currently given by Washington and others to Israel, could be seen as a weakening of the West’s military capabilities and willingness to fight a potential 3rd front. It could to the advantage of Beijing, as some hardliners will be explaining, but currently security of energy supply, the possible breakdown of the multi-trillion One Belt One Road project, and a struggling Chinese economy are topping the Taiwan dream scenario.

For Asia’s main economic and military power China, even that India is closing the gap, energy security and security of energy supply still rules foreign and military policy. As shown during the last 21 month, Beijing is cautious to be involved directly in military conflicts in its zones of interest. Even that China has been more than openly support Russian president Putin’s military adventure, currently more a nightmare for Moscow, it has kept out of overstepping the boundaries and redlines set by the West.

At the same time, Israel’s war against Hamas and its supporters, all Iran-backed groups and countries, puts China in a very difficult situation strategically. For its broad OBOR strategy, the role of Iran, Syria and Russia, are of pivotal importance, as it doesn’t hold yet the same power over most Arab countries at present. To take also the side of Hamas and others, China would be internationally facing major opposition, especially as until now Arab leaders, such as Egypt, Saudi Arabia and UAE, have shown major restraint in choosing sides. Their muted reactions versus Israeli military operations in Gaza show a much more open mindedness than ever before. For Beijing the latter is becoming an issue, as this doesn’t leave room for the Asian tiger to take advantage of possible fall-out actions. Beijing’s continuing support of Iran also still holds a danger for its growing cooperation with GCC Arab countries and its position in Egypt. A strong support of the Hamas-Hezbollah-Iran strategy could backfire severely. Until now Beijing plays the ‘mediator’, calling for a ceasefire, restraint by both parties and the ultimate end-solution of a two-state option.

Again, most Chinese actions show a prevailing economic focus, which is pushing military options to second place. China’s economic interests are pivotal until now, not only with the Arab states or Iran, but even with Israel, as Jerusalem and Beijing have been setting strong security-technology and economic cooperation the last years. China’s influence in Israel has been growing dramatically, but the current conflict could change this to the opposite.

Energy is key in China’s foreign policy again. Russia and the Middle East, including North Africa, are key targets for Chinese investors, military and politicians, as all are needed to supply the thirsty Chinese economy. On the long-term, stability in MENA is also key to the success story of OBOR. Without access, long-term strong economic and military relations between China and MENA, OBOR is dead, the still-born baby could be put to rest if Beijing plays its cards wrong. For MENA, China is also a major factor in its ongoing economic diversification strategies. Saudi’s Vision 2030 or Abu Dhabi’s 2030 depend on an influx of Chinese investments and operators, not only to set up new markets but also to construct and finance the major infrastructure projects ongoing. For Arab countries, as with Iran, China is a godsent, as it doesn’t hold the same constraints as Western investments. For Beijing the cards are still strong, but bluffing to much in this geopolitical poker game could cut it out also if played wrong.

As long as the Hamas – Israel conflict doesn’t become a regional war, China will be able to keep to its commercial strategies in the region, all linked or set up to keep its relations with major oil and gas producing nations in place. A regional conflict, which will involve not only Hezbollah, Syria and Iran, but also Arab countries will push Beijing into unknown territory. Until now China has not been very well equipped to choose sides without being hurt itself.

A major threat hanging over the market will be higher energy prices and a potential total breakdown of supply chains due to war in the Middle East. Higher prices and less energy access will kill the current very weak green sprouts showing in the Chinese economy. At the same time, supply chain disruptions with regards to its trade with Europe will do the rest.

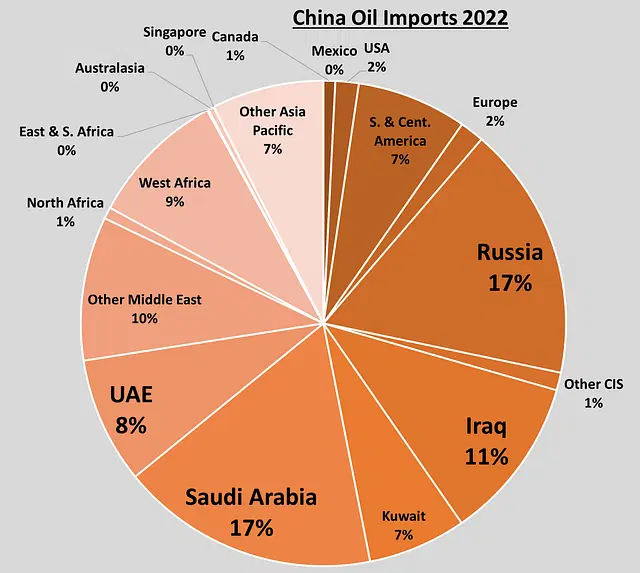

The world’s 2nd largest economy, China, is also the largest oil and gas importer in the world. At present, China imports 71% of its oil consumption from foreign countries. Most of its crude oil comes from Arab OPEC countries, leaving it exposed to destabilization in the region at a very high level. At present, Russia tops however the list of largest oil and gas exporters to China. Another threat to China is the fact that most of its manufacturing exports needs to be transported via the MENA region (Bab El Mandab, Red Sea, Suez Canal, Mediterranean) to Europe. Both economic lifelines to China’s economy will be cut.

Since years Chinese president Xi has made clear that energy security is a key priority. The Chinese leader has repeatedly emphasized the importance of energy supply and security as crucial for national development. The last years China has been investing heavily in the Arab world, with upstream and downstream as main targets, such as in Qatar, UAE, Saudi Arabia and Egypt. It needs to be understood to that China is already the largest trading partner for Arab countries, with volume of US$430 billion in 2022. Main partner is Saudi Arabia, with $106.1 billion in 2022, an increase of 30% in comparison to 2021. China’s investments in Iran increased by 150% in 2022.

Western military analysts are keeping an eye on Chinese military operation in the region too. At present, China has not a strong armed forces contingent in the region, but surprisingly the Chinese Navy presence is building up the last weeks. Reports are showing that around six Chinese warships are in the region. The Chinese ministry of defense indicated that the 44th Naval Escort Task Force has been in regular operations in the region since May. At present the task force is in the Persian Gulf, on an official good will visit to the littoral states. The task force entails the Zibo, a Type 052D guided-missile destroyer, the frigate Jingzhou, and the integrated supply ship Qiandaohu. There are no indications that these Chinese navy vessels are in place to confront US navy forces. However, looking at the broader picture, the presence of Chinese vessels will be constraining potential Western operations, especially in case of Iran.

History has taught us that the unexpected will happen, nobody knows however when. To expect and prepare for a Chinese involvement, for the first time ever in the MENA region on a military level is still not likely, but should be taken into account. The new China, led by Xi, who is clearly already engaged in an internal political power purge looking at disappearing officials and ministers, could be less predictable than before. The immense interests held by China in the region, partly caused by blindsided Western policies and Arab opportunism, now could lead to a new front. Energy, investments and trade, officially instruments of peace if you would believe some, are now clearly factors of instability and potential conflict. For the Chinese Tiger economy, access to energy and maritime trade routes will be pushing the limits currently in place in Beijing.