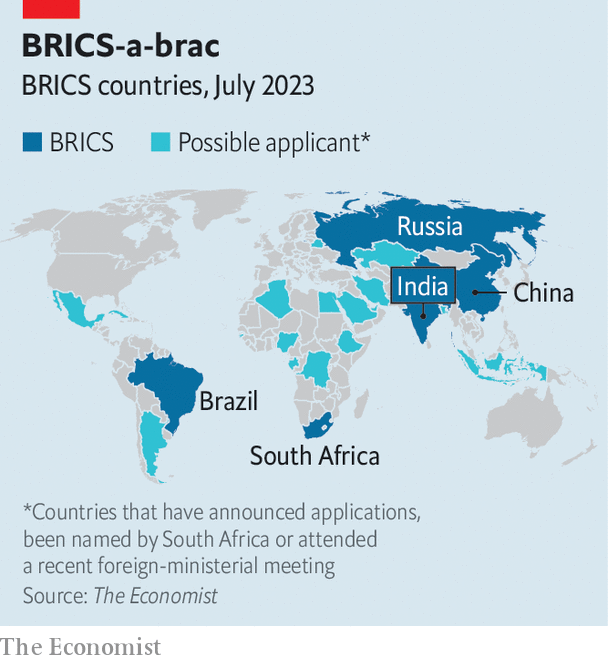

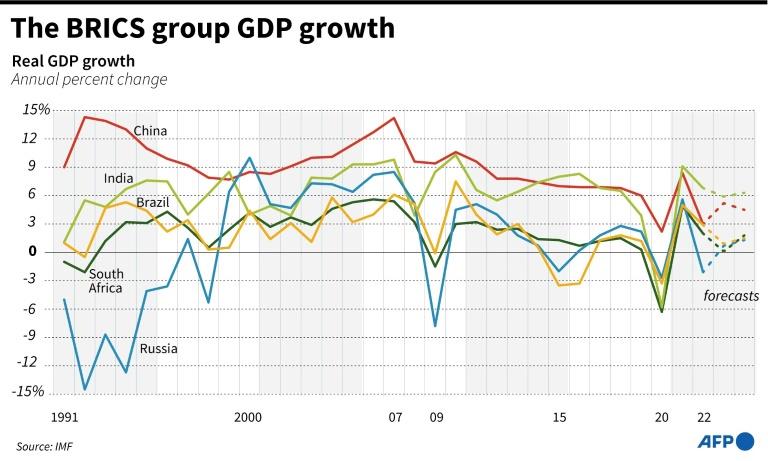

Between 22-24th of August, BRICS leaders will be meeting in South Africa. The currently still very loosely organized international grouping of leading non-Western countries, such as Brazil, Russia, India, China and South Africa, will officially meet to discuss increased cooperation, to counter Western influence. At the same time, BRICS is to expand its alliance by a vast group of the so-called “Global South”, mainly leading African, Latin American and Middle Eastern countries. A major challenge is being set up to the perceived geopolitical dominance of the West. At present, international media is largely discussing the perceived ‘de-dollarization’ efforts put in place by China, Russia and even some non-BRICS countries. The latter media attention is clear, as the position of the US dollar as the main currency of global trade could be under pressure. Still, the latter is largely fictious, as global trade is still over 90% done in US dollars, while Russia’s Rubles or China’s renminbi is not making a real dent overall yet. Financials will be very important, especially looking at the growing combined GDP of BRICS in comparison to the G7. The dream of the non-Western countries is also not new, as apparent already after the decolonization in the 20th century, and the economic miracles in China and now India. A new bi-polar world is emerging, but still far from being a real challenges.

International competition is not only heating up between the USA and China, but also between the so-called West and the Global South. In a move to increase its overall geopolitical position, China is trying to set up a major new economic block, officially to counter Western dominance, but under the surface supply chains, energy and overall commodities are at play. Beijing’s plans are being supported by most of BRICS countries, even that India and Brazil are voicing concerns. Strategic plans to increase the overall BRICS membership is largely being pushed by China and Russia, while India, as a traditional non-aligned power is concerned about Chinese dominance.

The last months China seems to be targeting a major expansion of the BRICS membership, some even see a major link to its former One Belt One Road (OBOR) or Silk Road plans. Beijing’s foreign ministry has officially stated that “supports progress in expanding membership, and welcomes more like-minded partners to join the ‘BRICS family’ at an early date.” Moscow, currently seeking friends to counter the impact of Western sanctions on the Putin regime due to its invasion of Ukraine, is also totally behind the Chinese approach. Main emphasis of both is the African continent, not only as some indicate to bring new sub-Saharan allies and strengthening their relationship with South Africa, but increasingly looking at the North African theater, where Egypt, Algeria and Libya are of the utmost importance to both. Geographically the importance of North Africa is clear, as it is the Southern Rim of the Mediterranean, and directly linked to Russian and Chinese interests, including access to the Black Sea region and Suez Canal.

With the theme of the 15th BRICS summit being “BRICS and Africa” all eyes are on the Dark Continent. Where Western media mainly see a threat to the position of the US dollar in the region, geopolitical and geo-economic analysis should again be looking at the main interest for global economies, aka mineral, mining, metals and energy. Without any doubt, Africa’s position is pivotal for energy transition, but….agricultural commodities are also playing an increasing role. The Food-Energy-Water nexus is playing an increasing role, even when looking at the invitations sent to new possible member countries. Most are major commodity exporters, with Arab countries becoming heavily involved in the supply chain and commodity trading space too. Asian powers, especially China, are aware of the latter.

Without decreasing the importance of the ongoing de-dollarization strategy of BRICS members, and the set up of the so-called New Development Bank (NDB), seen as an alternative to the Breton Wood institutions (IMF/World Bank), more focus is needed to address the potential backlash of a stronger and expanded BRICS on commodities and supply chain security. The fear for a BRICS currency are at present exaggerated, not even coming close to the WB commitments in reality. Looking at commodities, and especially energy or energy transition related projects and power projections, the power of an expanded BRICS is much higher than currently being recognized.

The coming months more analysis will be needed to address current and future changes and challenges to BRICS expansion. A major focus should be on the overall positioning of India, not only as a major rival to China’s current dominance, but also in relation to India’s growing cooperation with the West, and its ongoing strategy towards the Arab world and in future Africa. Where most analysis has been looking at China-Russia and MENA/Africa, India has slowly opened new inroads to Saudi Arabia, UAE, Egypt and even sub-Saharan Africa. India’s ongoing economic growth will need to be supported by energy (MENA-Africa) and minerals/metals supplies (MENA-Africa). Both will be needed to counter or mitigate Russia influence in both main sectors. India is also a proponent of bringing more democratic regimes into BRICS, such as Nigeria or Argentina, to mitigate the impact of more dynastic autocratic ruled new comers.

The current bloc holds 41% of the world’s population, 29% of global land area, and its members are all in the G20. The expansion of the bloc will not only increase the latter, but also will put in place major geographic and supply chain advantages, bringing a real global network in place of assets, ports and land mass. If a country such as Saudi Arabia will become part of a new BRICS+, it will entail not only vastly expanding economies but also direct access to major power players in energy (OPEC), renewable energy technology and investments (SWFs) but also increased geographic influence (Suez Canal, Red Sea, Straight of Hormuz, Persian Gulf). If countries such as Nigeria will join too, the circle is round, looking almost as the set up of the British Empire (where the Sun never goes down) or the former Dutch East Indies (VOC) and West Indies (WOC) structures, ruling the globe by maritime access.

The last of countries interested already in joining BRICS is impressive, but for Western interests and strategies should be worrying. Taking into account that it includes Iran, Saudi Arabia, United Arab Emirates, Argentina, Algeria, Bolivia, Indonesia, Egypt, Ethiopia, Cuba, Democratic Republic of Congo, and Kazakhstan, potential threats are clear but not being addressed.

Potential is especially of interest if BRICS and another Russia-China led alliance, Shanghai Cooperation Organization (SCO), should be merging in future. The SCO is a Eurasian political, economic, international security and defence organization established by China and Russia in 2001.

For traders, commodity houses and overall investors, BRICS or BRICS+ will be having a major impact. Geopolitics and geography will be key, while access and supply of commodities the main red line. Maritime access to all is playing a central role, worth keeping an eye on. Keep an eye on these analysis, as timing and opportunities are mostly hiding behind the headlines of major news-sites.