The future of the Egyptian economy is still very volatile, looking at the economic performance of most sectors, the weak government revenue base and the geopolitical challenges currently facing North Africa’s largest economy. The ongoing devaluation of the Egyptian pound and the repeated call by the IMF to restructure the overall economy, but especially selling the vast government stakes in companies around, is not going as expected. Still, Egyptian minister of finance Mohamed Maait stated to the press that deals worth $2.5 billion have been implemented by the state to exit from its owned companies within the initial public offering (IPO) program during the first quarter of the current fiscal year (2023/2024). The latter program, according to the official was put in place to support an increase foreign exchange flows, and to be able to support of the foreign financing required to cover the needs of the Egyptian economy.

The official response has come just after Egypt was hit by major downgrades by international rating agencies, such as Standard & Poors. The latter downgraded Egypt’s sovereign credit rating in local and foreign currencies from a B to a B-. The agency also stated that the overall outlook for all short term is still a B. S&P is not the only one currently very cautious or even outright negative about Egypt’s economic and financial stability.

All are very critical about the ongoing IPO strategy for government owned entities, which in reality are mainly in the hands of the Egyptian armed forces or its subsidiaries. The role of the armed forces in the current Egyptian economy is slated to be around 60%, which is not only a potential risk to stability but also confronts potential investors with a very bleak future. Still, the rating agencies have all indicated that their assessments are based on the current situation, while most have indicated to be prone to optimism if the IPO strategy is fully implemented, with all its hick-ups and constraints.

Egypt’s sovereign rating is very important, and as S&P indicated, it will have a major impact if the country is able to attract more international investments and foreign currency flows. Without mentioning it explicitly, the current influx of GCC, Turkish-Russian or Chinese investments has not been able to raise the overall picture to be more optimistic.

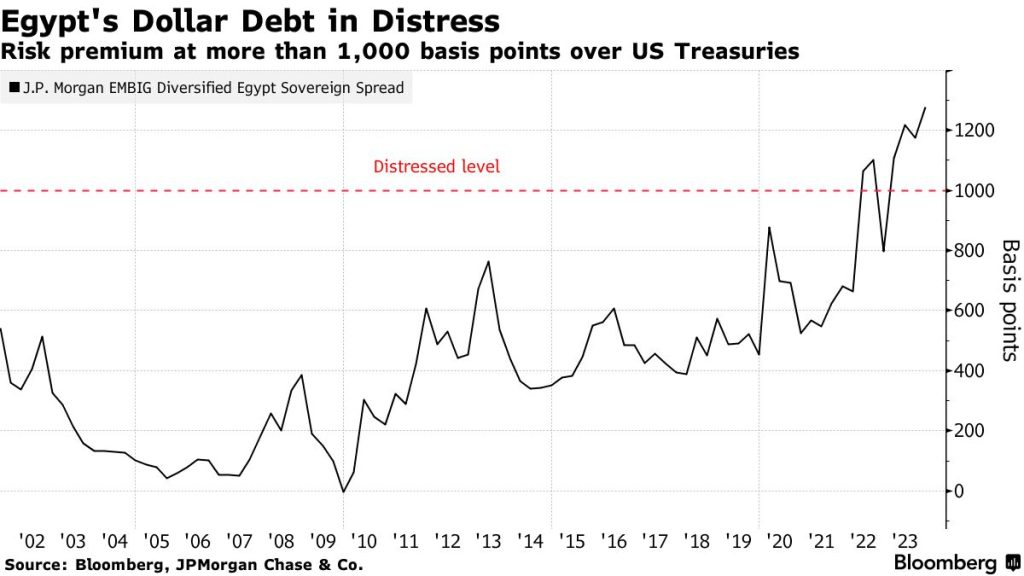

Taking all the proposed or targeted IPOs at present, analysts are still very worried about the potential of the country to reap major rewards, as these are needed to cover Cairo’s financing and external needs for the next two years. At the same time Cairo also needs to reduce its overall debts, which is seen by most investors and financial institutions as very critical.

Early October the Sisi government has already stated that it is going to offer shares in state-owned petrochemical companies and the Wataniya fuel station. According to Egyptian minister of petroleum and mineral resources Tarek El Molla, these shares will be offered within the next two months. According to sources, main interest at present is coming from the UAE, while investments funds also are interested. A growing indication is that the Saudi sovereign wealth fund Public Investment Fund (PIF) and maybe its Abu Dhabi compatriot Mubadala are interested.

Part of upcoming IPOs will be the sale of the Wataniya Petroleum, a company owned by the Egyptian Army’s National Service Projects Organization (NSPO). The company already has been split up by the government, with one new entity holding 174 of Wataniya’s 300 fuel plants. For the Wataniya IPO circus already 8 offers were submitted, of which only 4 are being discussed at present.

Between October 2023 – June 2024 Cairo also will offer other companies, such as power plants. Total amount for these parties is estimated to be targeting around $5 billion. Overall Egypt is going to offer stakes in 35 state-owned companies by end June 2024, all have been listed in in February 2023 (32 companies) while 3 additional ones have been added the last months, Eastern Company, El-Ezz Dekhila, and Telecom Egypt. A success is needed for Egypt as this is a very hard demand from the IMF, which is still discussing a $3 billion loan program with Cairo. Until now Egypt has not been able to meet the timeline and demands made by the IMF.

At the same time, Cairo is facing a total external debt of $165.3 billion, of which $71.6 billion will need to be repaid before 2026. To make matters worse, Cairo will need to repay already $29.23 billion in 2024.

The future is bleak, as the original privatization plans were already being discussed in 2018. Until now not a lot has been achieved, as even that Cairo is pushing internationally, investors are not showing very high interest yet in the offered stakes or companies. The latter is not caused by bad-performing entities or wrong sector focus. The potential companies on offer is rather impressive, as they entail the Port Said Container and Cargo Handling Company, Damietta Container and Cargo Handling Company, the Egyptian Ethylene and Derivatives Company, petroleum engineering firm Enppi, Middle East Oil Refinery, Assiut Oil Refining Company, the Egyptian Methanex Methanol Company, and El Wady for Phosphate Industries and Fertilizers.

In addition to the inherent bureaucratic rules still available in Egypt it is very doubtful the full list will be put on the market on time. As financial sources in Egypt stated, it is expected by banks and investors that Egypt will find it very difficult to complete even 25% within a year. Main underlying issue confronting investors or others in the current IPO process is that the fact that the main process for offering companies on the Egyptian Exchange takes six months for companies still not prepared for an IPO and three months for those who are. Overall, nobody is stating it in public, but…the role and stakes of the Egyptian Armed Forces, directly or indirectly via funds, is seen as a potential show stopper by most.

Since the start of the reign of president Sisi, the former Chief of Staff of the Armed Forces and Minister of Defense, the appetite of the Armed Forces has been growing exponentially. For most national megaprojects the military is currently delivering the backbone of all. At the same time, most of Egypt’s companies or government institutions is flocked by so-called former military, making the influence of the army on government budgets, regional budgets and even direct company strategies a major power to be. As one stated, the Egyptian army has expanded its empire beyond its historical turf, from the Suez Canal to hydrocarbons, transportation and telecommunications.

Looking at the non-Egyptian factors, the current war between terrorist organization Hamas and Israel is becoming a major point of concern. Unrest or outright war at the outskirts of the Suez Canal and the main population centers of Egypt is not to the liking of investors and operators. Increased regional tension or even a war with Hezbollah and Iran – Iran, the fall out will be devastating to Egypt’s current and short-term economic and financial future.