By Cyril Widdershoven

Reality bites back, as offshore wind hit by costs

The honeymoon of international offshore wind seems to be over, after worldwide major investors and operators are cancelling projects. The last weeks several major European offshore wind producers have cancelled three big projects offshore USA and in Europe’s North Sea region. Swedish green utility giant Vattenfall, owned by the government, announced to quit a projected offshore wind farm in the UK, citing inflation and other cost increases. At the same time Danish offshore wind developer Orsted lost a major offshore wind project in Rhode Island, cause by too high costs and Spanish utility Iberdrola announced that it has cancelled a contract to sell power from an offshore wind project in Massachusetts.

Even that most attention has gone to the offshore wind boom lately in the USA, the Americas are not immune for higher interest rates, inflation and manufacturing costs. Biden’s plans to support an exponential growth of renewable energy, partly to compete with China and the EU, could now be hit by reality, leaving the 30GW offshore wind power targets in danger. The US’s troubles are the same as in Europe’s offshore wind regions, such as the North Sea, offshore Mediterranean and even Atlantic. Cost increases are hitting not only the offshore wind producers, but also the whole industrial supply chain at present, causing major delays or outright non-commerciality of future projects.

As European offshore wind giants have been stating lately, rising costs of wind turbines are partly the main cause. In 2021 wind turbines already increased by 30% in costs, but additionally supply chain costs, materials and even yards are currently biting into projections. A possible hidden danger is the growing interest of European countries to auction their future offshore wind licenses, in principle to generate more government income, but in reality putting developers and financial institutions into a corner, as project costs could be staggering. The latest offshore wind auction in Germany is showing a tendency that could lead to higher costs, not only for developers but for overall consumers and industries alike. International oil major BP and TotalEnergies have bid between EUR1.5 billion and EUR2 billion per GW to German authorities. These bids were made to build four facilities with a total capacity of 7GW in the North Sea and Baltic Sea. These uncapped biddings will be hitting financials in future without any doubt. German’s example doesn’t stand on its own, as in France 73 bids were accepted in a tender last weeks, with an average price range of EUR 85.29 per MWh. The interest was high, as the auction was oversubscribed at 1.8 GW, so the government awarded 1.16 GW instead of the planned 925 MW.

Even that costs are increasing, European governments still see it as a very cheap option. The latter however is not anymore taken for granted by investors and operators at present. Another major issue offshore wind, and in general renewable energy, is confronted with in Europe is the fact that renewable production is increasing substantially but connection to the existing grids is becoming the main bottleneck. In Europe, as shown in the Netherlands, UK and Germany, the existing grid is facing full-scale congestion, forcing even whole regions to be taken off during peak production periods. In the Netherlands, renewables, especially offshore wind and solar, are causing threats to regional grids, while overall production peaks are only being able to cope with by selling electricity at negative rates. The coming years European grids need to be restructured, strengthened or even build new. Without this, future offshore wind (or even floating wind) will be looking at a doomsday scenario in which costs are increasing, licenses become expensive, peak production will be generating negative price settings, and connections to the grid are not available. Some have indicated that Europe will need an additional EUR150-165 billion extra to cope with these issues, on top of already know investment needs. When looking at the Dutch-NW German electricity grids, costs are already 2-3X higher than was stated before 2020. The Dutch grid owner TENNET, who also owns a huge part of Germany’s north-west grid, is struggling to counter these investment needs already.

Still, international interest in US-EU (offshore) wind is still strong, as shown by the latest plans of UAE’s utility giant MASDAR, which is an Abu Dhabi state-owned entity. In addition to Masdar’s plans to take advantage of US president Biden’s $430 billion Inflation Reduction Act with regards to (offshore) wind projects in the USA, the company also wants to expand big in Europe. Masdar’s main targets at present are in southern Europe, the Balkans and eastern Europe, with growth targeted in UK, Poland, Serbia, Montenegro and Greece. The Abu Dhabi company also has set its eyes on Central Asia, MENA and even Africa. To support the expansion drive, Masdar has raised this week around $750 million with debut green bonds. The money is being used to repay two $250 million bridge loans for a 200 MW solar PV project in Azerbaijan and 500 MW offshore wind project in Uzbekistan.

European gas demand and supply, Russia the elephant in the room 2023-24 winter?

The latest International Energy Agency (IEA), the OECD energy agency in Paris, reported a cut in European gas demand for 2023. In its latest quarterly gas market report (July 17), the IEA indicated a gas demand fall of around 7% year-on-year for 2023, mainly caused by lower gas usage for power generation and increased renewable energy. The IEA expects a gas demand of 489BCM in 2023, which is slight decrease in comparison to its former report indicating 498BCM. The Paris-based entity sees a 15% lower gas utilization in Europe’s power generation, lower electricity consumption in general and higher renewable energy production. Overall gas prices will be lower, but still far from its former cheap price levels. At the same time, the IEA predicts a demand fall for European residential and commercial sectors of 4% in 2023. For 2024 however a slight demand increase is expected, set at 1.5%.

For H1 2023 the IEA has set European gas demand fall at 10%, or more than 30BCM. The main culprit for the latter is lower gas usage in power generation, causing 70% of total fall. The IEA also said that gas-to-power demand dropped by 20% year-on-year in Q2.

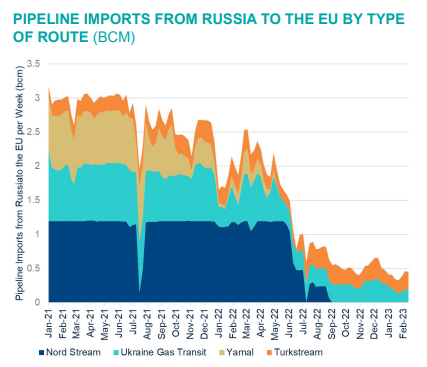

Overall gas supply has shown a major shift to LNG, as the latter is now close to 40% of total Europe’s gas consumption. Total gas supplies to Europe however have dropped by 13%, caused by Russia, as the latter gas exports to OECD Europe decreased by 65% in H1, year-on-year. Still, around 60 million cubic meters of Russian gas flows each day to Europe. The main entrance points are Ukraine based Sudzha entry point and via the European string of TurkStream, with deliveries currently averaging less than 2 BCM per months.

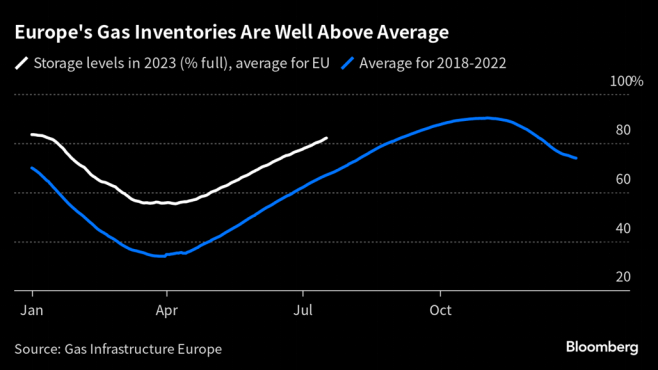

At present, Europe is experiencing all the advantages of lower global demand competition and a burst of additional LNG supplies from the USA. Combined with a very mild winter, demand has not been outpacing natural gas storage volumes. The latter have now reached record levels for this time of year, pushing most European politicians to be very optimistic about the upcoming winter. When looking at global gas markets right now, especially Asia, the latter is still reasonably weak, leaving enough room for European LNG clients to satisfy their hunger. A combination of high European gas storage volumes, fledgling demand at present in Europe and Asia, has pushed LNG prices to lower levels.

Still, there are several major Elephants in the room already. Asia’s appetite for LNG is clear, looking at the already extremely long list of long-term contracts being signed the last months by China, India, Japan and others. At the same time, European clients are not realizing that a growing amount of state-owned Asian entities have entered the market, taking up available volumes already that maybe Europeans were looking at from a spot-market perspective. At the same time, the ongoing heatwave in Asia, as in Southern Europe or USA, is putting pressure on overall power generation capacity worldwide. Part of the increased need for power generation is still not being met by renewables, but largely by hydrocarbons. Demand and usage of oil and gas is expected to increase substantially, as hydropower and even nuclear energy production plants are feeling the negative impact of heat waves and long-term drought. Increased demand is expected from India and Thailand already to counter increased demand at present by acquiring lower priced natural gas. As increased cooling demand will be eating into terminal stocks, additional demand is expected already. For South Korea and Japan above-average temperatures are already expected for August. Others have also stated that Japan’s storage levels are just above its five-year average, holding right now 2.10 million tons, but demand is going to be there very soon.

Europe’s situation is at present rosy, showing am 82.5% average storage level, expecting to hit 90% by November 1. However there are a clear threats on the horizon. As US LNG is a main deal breaker for Europe, the fact that US LNG is still available for Asia (Panama Canal), prices for European customers are already higher. There are indicators that most European regassification is at present unprofitable, so new LNG is not to be expected soon.

At the same time, one of Europe’s potential LNG suppliers is already since months out of the market, Egypt. At present, increased local demand for power generation has forced Egypt not to offer LNG on the market. Egyptian minister of petroleum Tarek El Molla stated the last days that his country will re-enter the market around October. Since June no Egyptian LNG has been made available. Based on normal circumstances, Egyptian (East Med) LNG will return to markets, but is still not a reliable substitute for Russian gas supplies.

Europeans seem to be sleeping again, after a short burst of activity due to the Russian invasion of Ukraine and the energy crunch. The optimism at present, shown in Brussels, The Hague or Berlin, is staggering, as they all seem to forget that ongoing Russian LNG and pipeline gas supplies (largely via Ukraine) are not set in stone. Europe is still depending on additional Russian gas volumes, available due to the fact that no sanctions have been put on it, or no military action has been seen against Russia’s vast pipeline infrastructure in Europe, but especially inside of Ukraine. In stark contrast to most people, Russia’s main gas producer Gazprom has even increased its gas exports to Europe. Latest figures for the first half of July show a 28% increase of Gazprom supplies to Europe via Ukraine and Turkstream. Reports state that average daily pipeline exports in the first half of July rose to 85.7 million cubic meters from 66.8 mcm in June. Gazprom total gas supplies in that period to the EU is set at 1.29 billion cubic meters (bcm) in July 1-15, while all of Russia’s pipeline exports are set at 13.4 bcm this year. They totaled 62 bcm for the whole of 2022.

Optimism is the only way to get through life or volatility, but realism should be in place at the same time. Europe’s dependence on Russian gas and LNG supplies is still there, both sides are just turning a blind eye. Moscow’s weaponization of energy has been a sore point for most politicians, but the latter is not yet dead, to the contrary even. Looking at Putin’s weaponization of agricultural commodities at present, Brussels and others should be wide awake and assess the options of a total blockade of energy exports by Russia to Europe very soon. The hard-needed transit extension of the Russian gas exports via Ukraine is one big issue to deal with. The agreement between Moscow and Kiev is going to be ended very soon, with no real solution for the upcoming period. Taking into account a possible demand growth in Asia, and a normal winter in Europe, current storages could be quickly used, maybe quicker than most expect. Without real other solutions to mitigate a lack of Russian supplies, Europe could be facing again a dire situation, in which it has again not acted prudently. By only looking at spot-markets, most Europeans will be hit by higher cost scenarios again. Europe’s industry also will need to get back on its feet, lower or stable energy prices here will be key. Higher prices will not kill economic growth long-term but it will deliver a deadly blow to confidence of voters and investors to politicians.

Saudi oil’s soft power competes in Iraq

The last week a flurry of meetings between Saudi and Iraq investment and oil and gas officials have been taken place. High level meetings between Saudi and Iraqi ministers to discuss the possible involvement of Saudi parties in Iraq’s hydrocarbon plays. Iraqi minister of oil Hayan Abdul Ghani as met with Saudi counterparts, discussing investments in downstream and infrastructure related projects. The meetings come at a critical time for Iraq, as the latter is trying to attract international investors to support its fledgling oil and gas sector. At the same time, a major soft power strategy is being played out, as Saudi Arabia, and its compatriot UAE, are vying for parts of the influence sphere that Iran until now holds in Baghdad. Abdul Ghani has met with Saudi assistant minister for oil and gas, Mohammed Abdulrahman Al Ibrahim. Already in May Iraqi officials broke the news that Saudi parties, such as Aramco, will be investing in the oil sector of the country. The UAE is also heavily pushing its own interest in Iraq. In October 2021 the UAE signed already a deal with Iraq regarding investments.

The expansion of power generation capacity. In 2023 a contract already was signed with General Electric to potentially add around 14GW to the country’s generation. At the same time, a contract has been given to Siemens to refurbish around 11GW of Iraq’s power capacity. Baghdad has also signed a contract with its Arab neighbors to import 500 MWh of electricity.

However, Saudi and UAE’s main focus will be on Iraq’s natural gas sector constraints, as Baghdad is still importing around 45 million cubic meters per day of natural gas from Iran. At present Iraq already has a production deal with UAE’s Crescent Petroleum to produce around 800 million cubic feet per day of dry gas from three oil and gas fields in Diyala and Basra. A sixth licensing round is being planned by Iraq for 11 exploration blocks, next to the already made deal with French major TotalEnergies.

Possible involvement of Saudi Arabia the coming months in upstream and downstream oil and gas is to be expected, but will be tricky as part of Iraq’s power structures are directly and indirectly linked to Iran. Turkey is also looking for multibillion projects, but has some additional conflicts already in place. As Iraq is already playing the Qatar-Turkey card, Baghdad realizes that current geopolitical developments inside of the Arab world, especially with regards to Ankara’s relationship with Saudi Arabia, Abu Dhabi and even Egypt, could remove part of its advantages held before.

Riyadh for sure is keeping a wary eye on all, but wants to put in place all its soft power options, including investments by major Saudi players, Aramco, SABIC and ACWA, but not forgetting the power projections available via the Kingdom’s sovereign wealth fund PIF. By opening up investment options directly for Saudi players, but also financing part or total projects, Saudi could not only remove the influence of Tehran in Iraq but also open up hydrocarbon prospects in future. The proximity of natural gas and oil fields in western Iraq are clearly to the advantage of Riyadh, as they are very close to the borders and easily accessible.

Everyone is looking on the bilateral geopolitical issues of oil and gas relations within the Iraq-Saudi Arabia constellation. Power politics however go much deeper than hydrocarbon exploration. Carving out Saudi influence spheres inside of a Shi’a ruled and Iran influenced Iraq is a win-win option for Riyadh. At the same time, it gives the Saudi regime much more power to back or block Turkey-China-Russia linked developments in the heartland of the Middle East, Iraq.

Gulf confrontation US-Iran heating up, oil price to follow?

It seems there are a lot of fans of Billy Ocean in Washington and Tehran, all dancing on the lines of his famous song “When the going gets tough, the tougher get going”. After months of threats and accusations from both sides about the failure of the JCPOA negotiations, in which the Biden Administration and Tehran have been trying to find a common ground, a new phase seems to have started already. Diplomacy at present is out of the door, hard-core power is now ruling the debate. Not only Iran’s increased aggressive is showing in the maritime arena’s of the Arabian/Persian Gulf, but also in other waters, such as the Gulf of Oman, or even offshore US East Coast and Latin America.

The heat is on, to use another song, but this time it could lead to a direct confrontation in which a lot of fingers could be burned. This weekend Iran announced a major air force drill, not offshore, but in the central part of the country. With around 11 Iranian air force bases participating in the drill, it is seen as a direct warning to the US that the country is prepared for a possible military confrontation. Iranian media are referring indirectly to the build up of US forces in the Middle East. Tehran is still refusing to discuss the links between US military and navy build up in the region and the continuing seizing and threatening by Iran’s navy and IRGC forces of commercial vessels in international waters. The Iranian news agency IRNA stated, an airbase to the south of the Bandar Abbas port, which is next to the Strait of Hormuz, is also participating in the drills. With around 90 fighter planes, bombers and drones participating, Iran is showing its muscles. Hamid Vahedi, Iran’s Air Force Chief General, said to the press that the drill is a “message of friendship, peace and security in the region.”

Since weeks tension in and around the Strait of Hormuz is building up, as Iran attempted to seize commercial vessels in the area. The last weeks, Iran tried to seize the Bahamian-flagged Richmond Voyager and the Marshall Islands flagged TRF Moss. Both vessels were shot at, but protected by the USS McFaul, a guided-missile destroyer. Iranian forces withdrew at that time. To protect its vital interests and international maritime traffic, Washington has now it is sending additional fighter jets and a warship to the Strait of Hormuz and Gulf of Oman to increase security. In the last two years, Iran has seized at least five commercial vessels.

Last week US Defense Secretary Lloyd Austin approved the deployment of the USS Bataan amphibious readiness group and the 26th Marine Expeditionary Unit to the Persian Gulf region. US military sources stated that the readiness group consists of three ships, including the USS Bataan, an amphibious assault ship. An expeditionary unit usually consists of about 2,500 Marines. The US Central Command did not name the ships or units, but stated that the deployment would provide “even greater flexibility and maritime capability in the region.” At the same time, A-10 attack planes are still in the region, all in response to the Iranian activity.

The new active deployment of US forces in the region is a show of commitment by the USA to the stability of the region officially. Without doubt the growing cooperation between the GCC states and China or Russia is raising eye-brows in US political and military circles. To expect a full-scale military cooperation between the Arab world and China is however still far-fetched, looking at the military capabilities of Beijing in the region or the full-scale dependency of all major Arab countries on military hardware and support for their own forces. At the same time the weakening of the outright anti-Iran front in the Gulf however is worrying, at least in the eyes of Western military analysts. The growing cooperation between Moscow and Tehran is a clear warning sign not to be ignored. Iran’s ability to restart diplomatic relations with former staunch anti-Iranian countries such as Saudi Arabia and Abu Dhabi (UAE) also is putting not only Washington but also Israel on alert. The latter is very concerned about the continuing rapprochement between Arabs and Tehran, as it could result in a more active Iranian threat towards Israel. Potentially the US military build-up should be seen as a support for Israel, likely to quell concerns about Iran’s nuclear capabilities or its support for Hamas and Hezbollah. Arabs will maybe be told that the US posturing at present will keep Israel from acting alone against Tehran.

Even that Washington’s move is a show of strength and statement to Tehran to refrain from action, the outcome is unclear. As the Arab/Persian Gulf holds not a lot of options to maneuver freely, a potential mishap is easy to be made. New Iranian moves towards international maritime traffic or outright threats to US vessels could lead easily to a direct confrontation with Iran. Possible fall-out is clear. A volatile or blocked Strait of Hormuz is a doomsday scenario that has been analyzed widely, especially for oil and gas markets. The main difference between pre-2020 and post 2022 is the fact that geopolitics and power projections have changed. Iran is a clear asset to China and Russia, making it much harder to unilaterally act against it. Iran’s naval assets and power projections have also grown, in stark contrast to most analysis in the media. Iranian vessels and naval forces are involved not only anymore in the Persian Gulf arena. IRGC capabilities and forces are spread throughout key areas in the Middle East, Latin America and next to the Suez Canal. A military conflict in the region could easily lead to global repercussions, most directly linked to US and Western interests. Oil and gas is a key targets, but commercial maritime routes are much easier to access and hit by current Iranian capabilities. New warfare capabilities, which are not anymore IRGC speed boats or missile technology, but mainly Iranian drones have already shown its impact in the Ukraine arena. Instability and military conflict at a time of fledgling markets or supply constraints are a toxic mix.