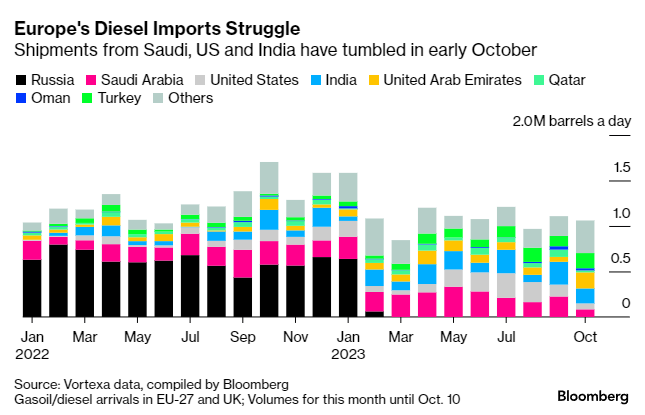

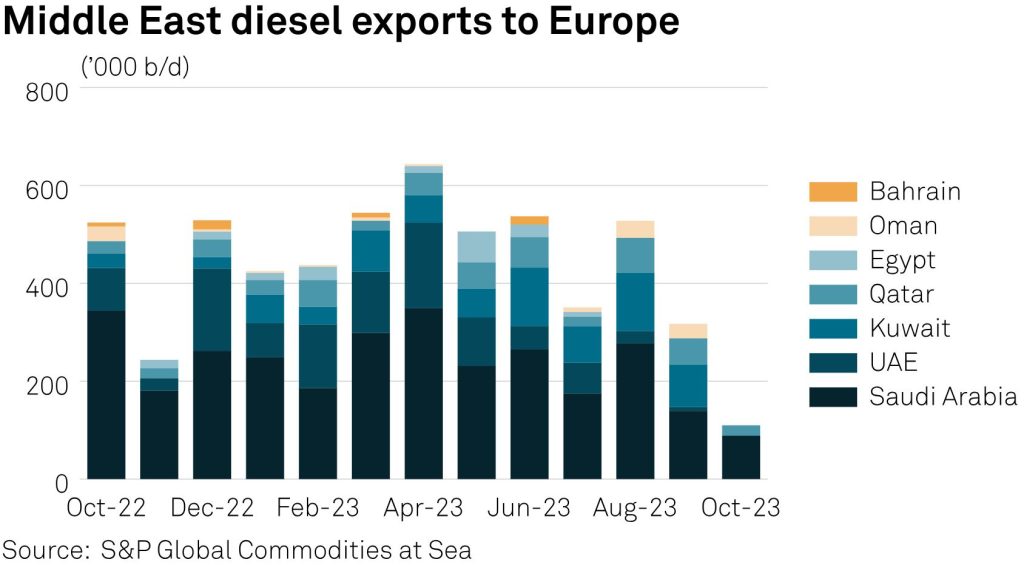

The European Union (EU) is worried about a potential shortage of petroleum products, mainly diesel, if war between Israel and Palestinian terrorist organization Hamas spreads to the region. In an emergency meeting set by EU members on Friday, officials have been discussing the option of setting up a buffer for diesel and gasoline, supported by diversifying oil stocks. EU commissioner for energy Kadri Simon has called for the emergency meeting to assess the potential supply risks of the expanding Hamas-Israel conflict, as the latter could be triggering destabilization of the MENA region. The latter is currently one of the main suppliers of fuels to the EU, after that sanctions were put on Russia, caused by Moscow’s invasion of the Ukraine. Last Friday the EU’s oil coordination group has met, but looking at the fact that the conflict is already raging for three weeks, it seems a little bit late in reality. One EU official, involved in the meeting, stated that “oil is important. Not enough diesel could lead to strikes. We don’t want our trucks queuing for diesel”. The statement also included a link to the 1973 oil boycott, but this is at present a little bit far-fetched, looking at the market fundamentals.

Whever a conflict arises in the MENA region, analysts are looking at the possibility of an Arab Oil Boycott 2.0 scenario, as the latter not only shocked global oil markets but resulted at the same time in a move by OECD countries to set up Strategic Petroleum Reserves (SPRs) to counter shortages. At the same time the direct link is clear, as the Hamas atrocities happened on the 50 Years remembrance of the start of the Yom Kippur War in 1973, the last time Arab countries and Israel went to war. OPEC reacted to the military support by the USA and several European countries, such as Germany, Netherlands and the UK, by putting in place a boycott of pro-Israeli countries. In reality, it was not a pure OPEC boycott but a Saudi Arabia-led Arab boycott strategy first. Overall, the real impact of the 1973-1974 boycott has been less than media still propones, triggered fuel shortages also have been caused by mismanagement or political strategies of OECD countries themselves. A new boycott, as has been called for by several OPEC members, especially Iran, still is not on the table, as most members, such as Saudi Arabia, UAE and others, are not willing to put it in place. Some feel that it is only going to benefit Iran (and its supporters) while it will be perceived in major oil importing countries as a very negative strategy, maybe causing new rifts between all.

According to the outcome of the EU emergency meeting, the main statements are still reasonably muted. It seems that the members have concluded that overall risks to the market, especially fuel supplies, are less in 1973. This assessment is based on the fact that the EU’s import dependency of oil its energy mix is less than 30% at present. The group still will be looking at all, as Saudi Arabia is one of its top three suppliers. The assessments also show that the EU feels a possible spreading of the crisis will be having mainly an effect on prices, while the real fear of a security of supply risk is less. Still, due to current market fundamentals, and the very tight oil market, due to unilateral Saudi supply cuts, it will be watched carefully. EU officials also expect that the current crude oil market tightness will ease in 2024. On which basis the latter assessments are based has not been divulged.

Criticism about these current assessments can be very harsh. In another reaction the EU indicated that their main concern is the Strait of Hormuz, as around 20 million bpd of crude oil and products goes through the latter. Around 20% of total global oil demand passes the strait between the UAE and Iran, making it one of the most watched transfer chokepoints in the world. The EU is worried that Iran could act against this maritime route, as it has done before during the Iraq-Iran war or is shown by very aggressive moves the last years of Iran’s IRGC naval operations. The focus on Hormuz is clear, but again shows that most officials are blindsided again. The last years, it has become clear that the whole region holds more threats to maritime trade than only the Strait of Hormuz. Houthi activities in Yemen (Bab El Mandab) and Red Sea are main choke points too. A spreading of the current conflict will for sure bring the Suez Canal and the East Mediterranean in the picture too. Iran’s navy already is in spread around the world, while IRGC assets ,operators and proxies are almost everywhere. With the missile capabilities of Hamas, Hezbollah and Iran, targets (including ships or chokepoints) can be reached up to main ports of the European Union. Assessing threats to fuels, such as gasoline or diesel, should at the same time include LNG, as the latter is the real lifeline for Europe, as we are approaching winter. A combination of MENA closures or supply chain blockades (Suez Canal/missiles) with the prospects of less Russian natural gas reaching Europe (see Ukraine’s standpoint on ending its transit agreement with Russia January 2024), is not to be forgotten or be taken lightly. Both sets of threats are linked, Moscow-Iran is involved on all sides.

For Europe the situation could be very tricky. Even that the continent (even the UK) have SPRs set up with oil stock holding a 90-day requirement, most of stocks held are crude oil, not products or fuels. Turning these crude oil volumes into fuels will not be easy, as the EU members have been lacking in investments in refinery capacity or even closed down some. With European heavy transport relying on diesel, the sector could be facing a shutdown. Current SPRs or strategic stocks are holding an equivalent of 90 days of net imports, or 61 days of consumption. The EU emergency meeting also included representatives of the International Energy Agency (IEA), the OECD energy watchdog and industry.

At the same time that the EU was discussing security of energy supply issues, the IEA stated that it has not yet started any discussions on oil stock releases. According to Keisuke Sadamori, Director, Energy Markets and Security, the IEA’s oil market report already indicated tightness in the oil market in H2 2023. The IEA official stated the current situation is a sign of the latter. Based on IEA’s assessment of the Hamas attack on Israel, not physical supply disruptions have yet been seen. This is strange as Israel already has been hit by some oil supply chain constraints, while East Med oil and gas operations are either shut in or on low level. Sadamori said that the IEA is ready to act when necessary. Until now, Sadamori reiterated, the IEA and its members has not yet started talking about any specific action.

The EU-IEA, and possible USA, approach seems functional but could be backfiring due to its slow pro-active implementation. Again, to counter geopolitical or outright military risks is hard for governments or international bodies, while the signs are clearly visible on the horizon. It is also is very clear that even that Russia-Ukraine has been going on for almost 2 years, resulting in an energy crisis and high volatility in oil and gas markets worldwide, it still looks at no lessons have been learned still. To think the unthinkable or just start thinking out of the box are necessary qualities that these organizations don’t seem to possess. To realize that part of the problem is not the oil and gas market, OPEC or Russia, or even terrorist attacks, but a renewable energy strategy that is now biting its own tail, is rather worrying. Since several decades Europe has been pushing out the vast power of domestic refining while being reliant on the 3rd party supplies. Even the Netherlands, a former big shot in downstream, holding up-to-date refinery capacity, has gone down the same road. Simply said, crude oil, even that consumers still believe it, is not being put in the tank of a car, truck or even your generator or heaters. Again security and stability of the overall economy and consumers has been put at risk, now we need maybe to sit on the blisters.