As stated before, Europe’s natural gas and security of energy supply is still very weak, as it depends on a wide range of international supply options. The last years, the East Med region, entailing mainly the Egyptian-Israeli offshore gas production and potential LNG exports, has been a major focus point for European companies to access and diversify their natural gas volumes. Holding vast offshore gas reserves, the East Med is a logical supplier to European markets, but geopolitics and instability now is removing the latter with a bang. During the weekend the Egyptian government stated that it has suspended all its natural gas imports from Israel due to the threats of the current war between the latter and Hamas. At the same time, Cairo has reiterated that it will be extending the already existing power cuts throughout the country, as demand is currently higher than supply.

Egypt is facing a very dangerous situation, as it is now facing a direct cut in imports of around 800 milllion cubic feet per day (cfd), while it is also mitigating the effects of higher electricity demand due to higher than normal temperatures. One of the underlying reasons for the total cut of Israeli gas volumes is the decision made by Israel to shut down its offshore Tamar gas field, while increased security threats also are expected to shut down the remaining offshore production. At the same time, Cairo is facing increased instability in the Sinai too, as Hamas and proxies are already looking at possible actions in the area.

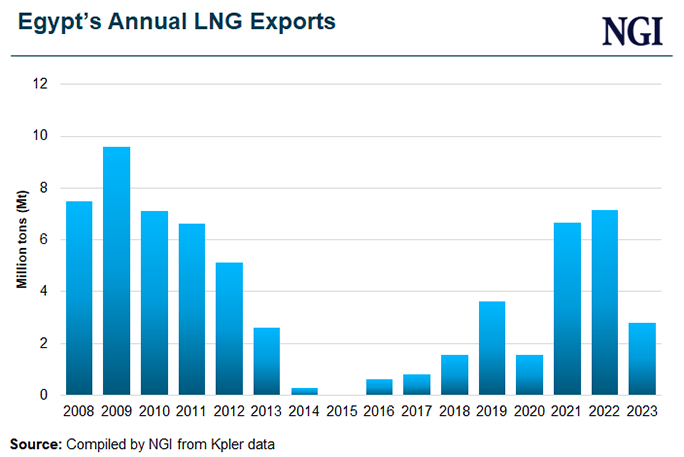

Egypt is currently importing natural gas from Israel, partly to counter growing domestic demand, while targeting full scale LNG exports at the same time. Until now, Chevron, the operator of the Tamar gas field, has stated it has been committing to volumes to Egypt. The last weeks optimism about Egypt’s LNG export was growing, after that Italian oil and gas major ENI stated to the press that it expects Cairo to resume LNG exports as domestic demand was decreasing. The latter is now however reality, forcing full stop on LNG exports. The North African country is now not only facing a debilitating economic situation, in which severe foreign currency shortages are playing havoc, but it also loses one of its main future revenues earnings.

Egypt’s power cuts started in July 2023, but Egypt’s prime-minister Mostafa Madbuly reiterated at that time that power supply would be normal again by September. This however has not happened, and fears are growing that even more power cuts will be in place for a prolonged period of time. Mainstream Egyptian population still expects that domestic gas production can cope with all, as Egyptian media reports are tainted. At present, demand however has increased substantially, while domestic gas production is declining. The last years, the lights have been kept on due to import of Israeli gas volumes. The shut down of the Israeli Tamar offshore gas production already was shown the last weeks, as Israeli gas exports to Egypt went down from 800 million cfd to 650 million cfd. Egypt also has to cope with the situation that Israel is currently prioritizing its gas production for internal demand. Chevron stated that Israel’s Leviathan production has also been reduced slightly.

Chevron, which operates Leviathan, the largest Israeli gas field, also rerouted its supplies being exported to Egypt in early October, saying that instead of piping them directly to Egypt via the EMG pipeline, it would instead send them via the Arab Gas Pipeline that goes through Jordan. Anonymous energy industry sources cited in Reuters at the time said that “the amount of gas exported from Israel’s giant Leviathan field to Egypt has been slightly reduced as supplies to the domestic market are prioritized.” Egypt’s power production is 75%-96% based on natural gas usage. The remaining is being supplied by fuel oil (Mazut). Due to the ongoing shortage of foreign currency, there is also a shortage of mazut in the country. International rating agency Standard & Poors already stated before that part of the downgrade of Egypt is due to its ongoing energy deficit.

For Egypt’s government the task to deliver power, while confronted by an economic crisis internally, and at the same time confronted by increased popular uproar about high prices and the Gaza crisis, is a threat to stability. The coming weeks, Cairo will have to deal with all, while also heading for presidential elections. The outcome of the latter is already clear, Sisi will continue as president, but internal stability is at risk.

Analysts are worried as energy, food and inflation issues, always have been a major destabilizing factor in Egypt’s politics. Popular opposition could be returning to the streets, most probably under the flag of the Palestinian issue, but for sure supported by Moslim Brotherhood and others. A destabilized Egypt, or maybe a real violent reaction, is going not only to threaten the region, but at the same time will put Europe’s energy supply and maritime trade under pressure. While the Middle East is back on the front page of western media, a combination of no Egyptian LNG volumes hitting the market, while Ukraine is heading to end Russian gas transits by January 2024, will be a major dent in the current optimism inside of European politics about the state of natural gas storage and supply during winter 2023-2024.

At the same it has become clear that the European strategy, which has been pushed by Brussels politicians and US government officials, to build the so-called East Med Gas Pipeline between Cyprus – Greece, will need to be buried. Already analysts have been stating before that the costs of the deepwater offshore gas pipeline is not commercially feasible, but the current situation, Hamas-Israel or Israel-Hezbollah-Iran, is showing the issue to be dead before arrival. Turkey’s growing extremism in its support of Hamas, and the ongoing conflict with Cyprus-Greece, is also a major factor in play. Europe also will have to reassess the other options for natural gas or LNG imports. Without any doubt the Israel-Hamas crisis will have its effect on other supply options too, as Libya, Algeria and Qatar are under pressure. With increased instability in the region, but most probably inside of Egypt too, supply routes of LNG, especially Qatar’s LNG, are not 100% secure. US LNG is getting a slam dunk looking at this developing situation, while Moscow is smiling on the background. Remember that Europe is still importing Russian LNG, while it is very active in pushing FSU gas suppliers to keep their pipelines to Europe available. Turkey is very keen to be a major supply route to all.