by Cyril Widdershoven

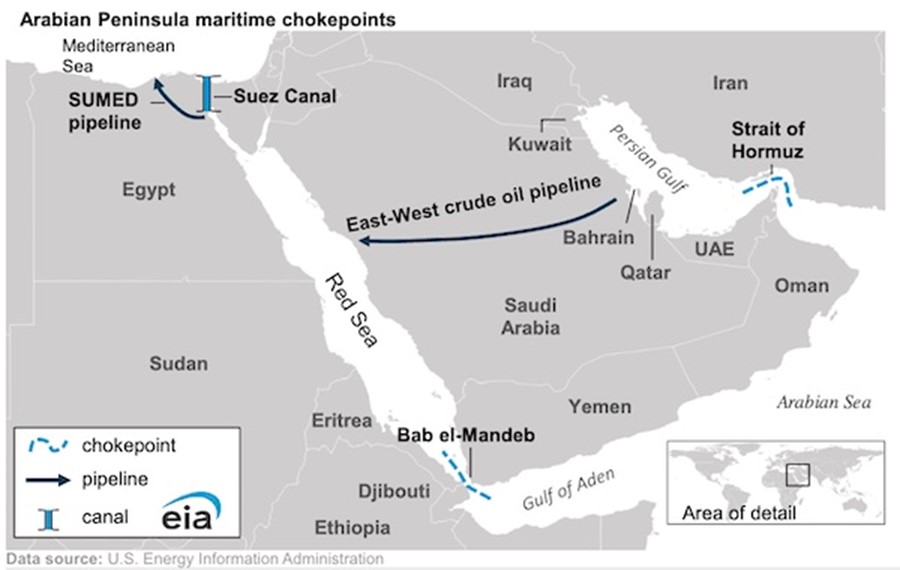

Global maritime trade and geopolitics are again back on the front page. With a minimal effort, market players have been woken up out of their own perceived winter hibernation, as Yemeni terrorist organization Houthis threaten to block one of the world’s main maritime chokepoints. While the media is now framing the latter as a Red Sea maritime security issue, the real situation however is much more diffuse than only the Red Sea, as it includes the Gulf of Suez (Suez Canal entrance) and the Bab El Mandab (or Strait of Aden). After decades of military and geopolitical assessments of the Strait of Hormuz (the waterway between the Arab Gulf States and Iran), potentially blocking a vast amount of crude oil, LNG and petroleum products if closed down, the world now realizes that in an interconnected global economy 3rd parties can be playing on several chess boards at the same time. The main question however is at present, what does the party involved, Houthis, try to achieve with harassing global maritime trade or which players are behind the current crisis situation? Is it a Houthi military action against Israel or a diversion tactic of Tehran?

At the same time, a more thorough assessment is needed to address not only current threat scenarios but also the need to quell future crisis in and around the Red Sea/Suez/Bab El Mandab arena’s, which not only involves Israel, Hamas-Hezbollah-Houthis, but increasingly USA, EU, UK, Gulf Arab countries, Egypt, Iran and new emerging powers such as Russia, China, India. Without a new regional maritime security regime or involvement of inter-alliance groupings, global trade or commodities will be heading for vastly higher volatility than ever before.

On December 16 news emerged that a UK destroyer, HMS Diamond, has downed a suspected attack drone in the Red Sea. The destroyer has been in the region since last month, to shore up security in the Gulf. The UK ministry of defence has stated that the Type 45 destroyer is currently conducting operations to ensure freedom of navigation, reassure merchant vessels and ensure the safe flow of trade. This statement now is one of an ever growing lists of potential military engagements by international naval forces in light of the direct threats and actions undertaken by Yemen’s main rebel group Houthi. The latter has been targeting Israeli-owned or bound vessels since the Hamas massacres on October 7, which have killed around 1140 innocent civilians and Israeli soldiers. Since the Israeli war on Hamas, and Israeli military operations inside of Gaza, the Iranian backed Yemeni extremists have been targeting not only ships in the Red Sea or Bab El Mandab, but also fired long-range missiles and drones on Israel itself.

In a reaction to increased attacks by Houthis or perceived 3rd parties, major international shippers already have stated that no vessels will be transferring through the Red Sea anymore until further notice. Last Friday, two of the largest shipping companies, Maersk and Hapag-Lloyd have suspended passage through the Red Sea. The Red Sea, with its direct links to the Suez Canal (Egypt) and the Bab El Mandab, is one of the world’s most vital commercial shipping routes.

At the same time that ships are being targeted by Houthi missiles or speed boats, trying to hijack vessels perceived to be on route to Israel, the Yemeni rebels also are firing long-range missiles and drones towards Israeli territory, flying over Saudi Arabia and other neighbors. Egyptian military sources have already indicated that they have shot down a suspected drone off the Red Sea coast near the resort town of Dahab on Egypt’s eastern Sinai coast. In October, military sources already have stated that Yemeni drones hit two other Red Sea towns.

Officials of Maersk have stated that all its vessels in the area that had planned to pass through the Bab al-Mandab Strait have been instructed to pause their journeys. Two of its ships have been already targeted lately, such as a near-miss incident involving the Maersk Gibraltar 14 December. German container giant Hapag-Lloyd’s Al Jasrah was also attacked. All the incidents in the Red Sea have been at present claimed by Yemen’s Houthi rebels. The reactions of most other shippers is still unclear, but it seems to be clear that current volatility in the area is going to have a major impact on international maritime trade the coming weeks.

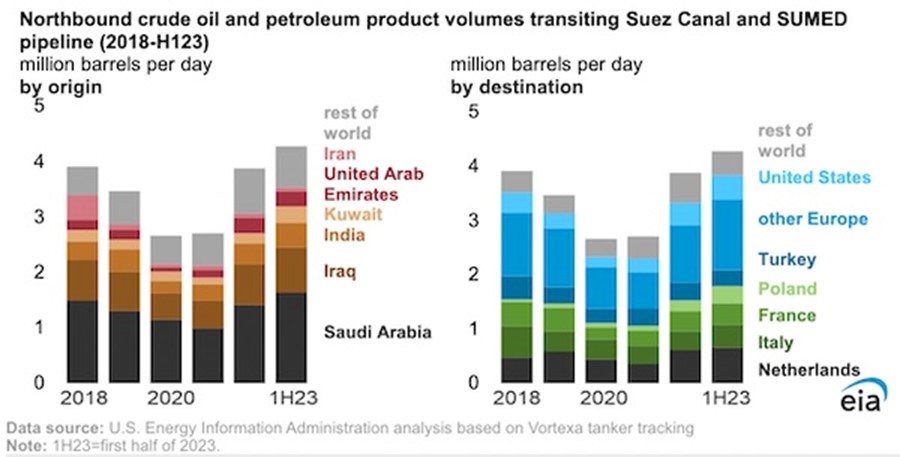

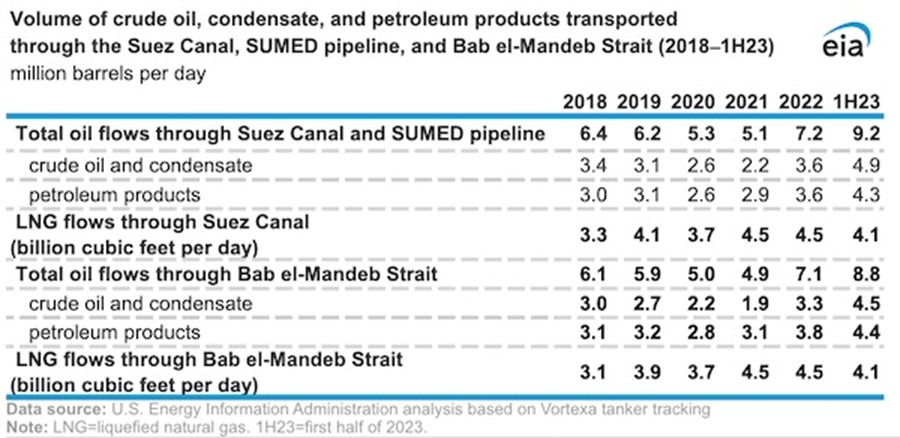

There have as yet been few signs of tankers avoiding the area, which is vital to global oil trade. Shipments of all types of oil through the Suez Canal, at the north end of the Red Sea, either by tanker or through the Sumed pipeline accounted for 12% of seaborne-traded oil in the first half of 2023.

All eyes at present are on the USA and its Western allies, which have major naval assets in the region, or could be steaming up within days to engage possible threats. The last week the Houthis have severely escalated tensions, showing no indication to even consider to back down. The willingness to even engage US warships, such as the USS Carney in the Red Sea, doesn’t bode well. The surge in Houthi actions, combined with indiscriminate targeting in and around the Red Sea, necessitates quick and appropriate action by regional and/or international powers. Until now the USA seems to be tasked, as perceived in the region, to give a robust and consistent response to the Houthi operations. Analysts are however very worried that the single focus on the Houthi operations clouds the more overarching need to respond to the powers backing the Houthis. Without any doubt Iran’s leaders, or especially the hard-core extremists inside of the IRGC, are backing or even coordinating the current Red Sea escalation.

Without any pressure or military action against Iran and its proxies, Tehrani leaders will be emboldened to even up the confrontation, potentially leading to a direct and regional confrontation with the West, Israel and even Arab Gulf countries. Miscalculation on either side is a main threat not seen yet, as Tehran already holds several cards and is playing on a wide-range of chess boards, such as Hamas, Hezbollah (Lebanon), Syria and Iraq. The Houthi actions should be not only seen in the light of these strategic positions, but also as a major escalation which has not yet been even met yet by real counter measures.

As the Houthis are also part of the so-called Axis of Resistance, any actions taken by the Yemeni group should not be seen as a unilateral independent move but as part of the direct regional strategies of Tehran hard-liners. To make the Axis of Resistance position even more clear, the latter doesn’t only include the well-known terrorist groups in the Middle East, but also various other militias comprising fighters from Afghan, Iraqi, Pakistani, and Syria, which are not only deployed throughout the region but also have strong positions in Latin America, Asia and even Europe. Their main military approach is to be able to attack Israel, USA or Western positions worldwide. For Tehran the Houthis are a key-strategic partner, not due to their military capabilities or regional impact but mainly based on the geographic position, as they are close to several of the world’s main maritime chokepoints. Tehran has been since years targeting assets or direct access to ports in and outside of the Red Sea arena, such as Sudan, Horn of Africa or elsewhere. For Tehran it is of vital importance to hold a supra-regional position to be able to threaten maritime security and to be able to disrupt global shipping. At present, Iranian navy vessels are already sailing around the world, with access even to several Latin-American and African ports.

The direct involvement of Iran in the current Red Sea maritime escalation is clear to some, but seems to be ignored by most. The last years the IRGC, the hard-core Iranian Islamic military group behind the Tehran region, has been supplying ballistic missiles and drones, along with training, technological expertise, and equipment. They also have provided technical support to the Houthis to either upgrade or develop their own indigenous systems. Military analysts have warned since years that the IRGC has provided an anti-ship ballistic missile called Tankil, closely resembling the IRGC’s Raad-500 missile. Another is the Typhoon, reportedly capable of striking targets up to 1,900 km., similar to the IRGC’s Ghadr ballistic missiles. Additionally, there’s the Hatam, similar to the IRGC’s Kheibar Shekan ballistic missile with a range of 1,450 km. The IRGC’s drone arsenal also has been made available to the Houthis, who have received several types of drones, including the Qasef-1 UAV, nicknamed kamikaze, which is used to target coalition missile defense systems in kamikaze-style attacks. The militants also utilize the Vaeed-2 (Shahid 136) and Ababil drones, fitted with high-explosive warheads, to engage high-value targets such as radar installations and Patriot missile batteries. When looking at the maritime space, Iran’s IRGC has been delivering also with unmanned, remote-controlled boats loaded with explosives, naval mines, and anti-ship and man-portable missiles.

With the military support of the IRGC, the Houthis have evolved into a major military force in the Arabian Peninsula. The group now has full control over the Bab al-Mandab Strait, through which 10% of global oil is transiting, enabling them to disrupt global shipping and compromise the safety of navigation in the Red Sea’s strategic waterways. Arming and training aside, Houthi attacks on vessels and firing missiles at Israel are coordinated and fully enabled by Iran. According to open intelligence sources, Houthi representatives had discussed their recent attacks with regime officials during a meeting in Tehran in November 2023. Nasser Imani, a political analyst close to the regime, said “Iran considers Houthis in Yemen a major player and… more of a threat to Israel in the long term than Hamas or even Hezbollah.”

The current approach taken by the West, under leadership of the USA, is to set up a “broadest possible” maritime coalition to protect ships in the Red Sea and send an “important signal” to Yemen’s Houthis that further attacks will not be tolerated. US National Security Advisor Jake Sullivan stated already last week that talks are being held with other countries to set up a maritime task force. Iran already has reacted by stating that such an international force will be facing “extraordinary problems”. U.S. Special Envoy for Yemen Tim Lenderking stated this week at a Doha conference that said the U.S. wants the multi-national coalition to send “an important signal by the international community that Houthi threats to international shipping won’t be tolerated.” At present, a task force is already working in the Red Sea and Gulf of Aden, known as Combined Task Force 153, which is a 39-country coalition commanded by the vice-admiral of the U.S. Fifth Fleet, based in Bahrain. Discussions are already held between the US and China, as the latter is not part of the task force. Beijing’s position is rather difficult, as China is not only a heavy user of the Red Sea route but also are heavily involved with Tehran.

At the same time, another major party in the Red Sea trade is not yet showing face, Russia. In 2022 around 73% of all Russian crude oil was shipped via the Red Sea to its main markets China, India and the Middle East. With the Suez Canal, the SUMED pipeline and the Bab El Mandab, the Red Sea is pivotal for Persian Gulf oil and natural gas shipments to Europe and North America. In H1 2023 12% of global sea-borne oil was shipped via this route, while LNG shipments hit around 8%.

A possible maritime or military blockade of the Red Sea arena will at the same time not only hit major commercial maritime trade but has the potential to put a major shock to the current volatile crude oil and gas markets too. For one main player, Egypt, two threats are on the horizon, as both the Suez Canal and SUMED pipeline are Egyptian. The pipeline transports mainly crude oil from the south of the Canal area to northern ports, with a capacity of around 2.5 million bpd. As most crude oil, petroleum products and LNG exports from the Persian Gulf to Europe and/or USA go through all these chokepoints, the role of the region is clear, maybe even more important than the Strait of Hormuz.

Since the COVID shutdown, northbound crude oil flowing through the SUMED pipeline and Suez Canal have increased by over 60% in comparison to 2020. Less strict implementation of Iranian sanctions have allowed additional volumes the last years, while EU-Western sanctions on Russia has forced Moscow to reroute global oil transports. While Europe has been importing more Persian Gulf oil and gas, including products, Russia has been setting up a contrary flow, looking for MENA and Asian customers.

Last figures show that southbound shipments have increased substantially, especially after the Russian invasion of Ukraine and the following Western sanctions. Oil exports from Russia accounted for 74% of Suez southbound oil traffic in the first half of 2023, up from 30% in 2021. Most of those export volumes were destined for India and China, which imported mostly crude oil from Russia. Arab countries, especially the UAE and Saudi Arabia, have been importing Russian oil products, either to be used in their own power generation or to be re-exported, such as Russian diesel.

When looking at LNG shipments through the Suez Canal, northbound volumes have increased substantially, as main LNG exporter Qatar has been focusing on the European markets since the Russian invasion of Ukraine, with less volumes heading to Asian partners.

With around 23,000 ships each year passing through the narrow Bab al-Mandab Strait connecting the Gulf of Aden with Red Sea and beyond to the Suez Canal, the pivotal role is clear. Not only for energy related volumes, but also food products like palm oil and grain and anything else brought over on container ships, which is most of the world’s manufactured products.

The coming days it will become clear if the West will take its geopolitical role, and will act to remove the present danger. Military operations against the Houthis should be expected, as the normal diplomatic Western strategies are not working at all. Even potential involvement of Israeli navy or special forces has not yet quelled the existing dangers. Regional power plays are at play, in which not Washington, Brussels, London or even Moscow are holding the cards, but powers such as Iran, Saudi Arabia, UAE and even Egypt. A full-scale doomsday scenario could be easily become reality, if Arab powers will not be able to wait for a Western reaction in full. Never underestimate the willingness of Arab powers to take the matter in their own hands. Houthis are already since long on a black list of Riyadh-Abu Dhabi but also Cairo. Iranian power play has been allowed the last months, but if real military-economic security threats are being put on the table, Cairo and Riyadh will not be waiting. A full-scale blockade of maritime traffic in the Red Sea will not be allowed by Egypt’s president Sisi’s regime, which already is in dire need for external funding and higher Suez Canal revenues. Saudi Arabia will also not be willing to have foreign investors in its giga-projects become wary or even scared by actions of the Houthis and Iran. The dark horse in all, Israel, is not yet at play, as its analysts will have made the rational assessment that others will be removing the Houthi threat in the nearby future.

Iran however is until now too quiet. As Houthi power broker, and arms supplier, Tehran holds a real power in the Bab El Mandab region. For Iran, the current media focus on the Houthis, and the real threats to maritime trade, are a welcome distraction in light of the looming Israel-Hezbollah confrontation in southern Lebanon. By engaging others (3rd parties), Iran is clearly trying to split the anti-Hamas/Hezbollah-Iran front, making an Israeli military move against Hezbollah less desired by all. Hardliners in Iran, combined with extremists in Gaza, Lebanon-Syria, Yemen and Iraq, understand the military principle that it is much harder to act when confronted by a multi-front situation. Still, by engaging a super power, with possible support of still largely anti-Iranian Arab regimes, while Israel is ready to act within 60 minutes, is maybe playing with fire, potentially a fire that could consume its arsonists.

Without any discussion, the MENA region, including its vast maritime trade routes and links to global markets and powers, is heading for a much more volatile and dangerous 2024 than could have been foreseen 10 weeks ago. Power plays are at play that could not only change the region, but have a global impact on trade, energy flows and future maritime trade routes.

Short term impact will be on costs of trade and vessels, insurance and for sure energy. Until now Gaza-Israel has been not having an impact on crude oil prices or products. A mid-to-long-term closure of the Red Sea, combined with a much longer trip around South Africa (Cape), will be pushing overall prices up.