Egypt’s financial dependency on Gulf Arab states continues to increase. Some may even wonder if President Sisi’s regime is not selling out the crown jewels of Egypt to the Arabs, which will not only potentially remove Cairo’s maneuvering space on the global scene, but also could put MBS and MBZ pulling all strings. Knowing the simmering anti-Gulf Arab sentiment of the Egyptian population, due to misperceptions and former political-military confrontations, president Sisi needs to stay alert, as his current moves could be backfiring.

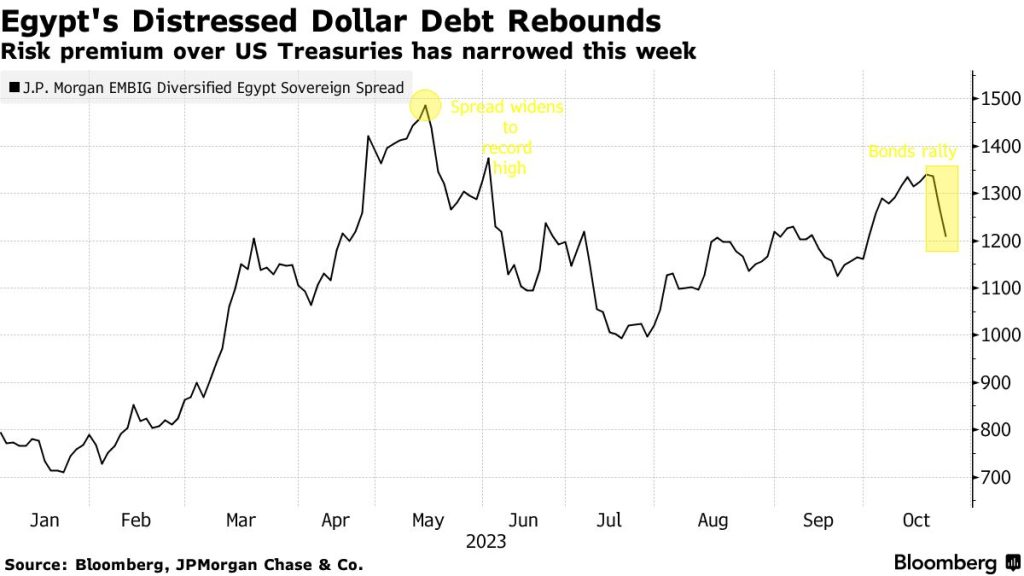

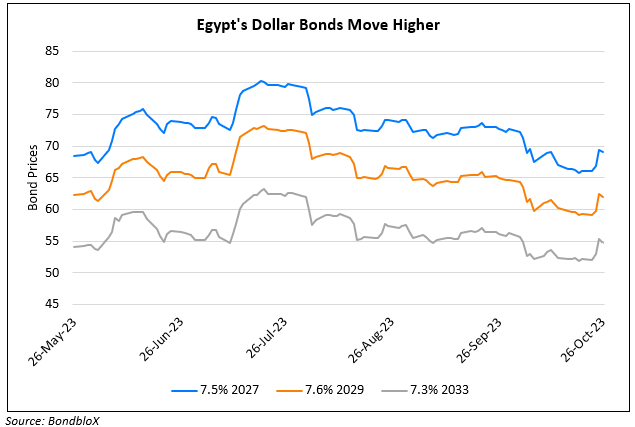

Caused by a struggling economy, increased inflation levels, rising government budget deficits and a continuing weak currency, Egypt is facing a Sisyphus task. As Western financial institutions, such as the IMF, WB or EBRD, are getting more critical and cautious, while access to financial markets is constraint, Cairo is looking for a major additional financial influx of Gulf Arabs. At present, discussions are ongoing between Egypt and its Gulf Arab counterparts to bolster the reserves of Egypt’s Central Bank. The main targets set by Cairo are to receive new deposits of Saudi Arabia and the UAE, in a way to have more time to deal with the very difficult discussions with the IMF. Egyptian media quotes sources stating the deposits current under negotiation are said to amount to around $5 billion, which could be transformed later on into Gulf Arab investments in the country. An influx of $5 billion would be very positive, at least in the eyes of the beholders, but would also at the same time increase Gulf Arab deposits held by the Egyptian Central Bank to $34.9 billion, as the latter already holds $29.9 billion. Sources have indicated that the $29.9 billion are divided into around $15 billion medium to long-term, and $14.9 billion in short-term deposits, both from the GCC and Libya. The latter is remarkable, looking at the debilitating situation of the Libyan economy at present. The discussions are also slated to include a possible deal to renew the existing deposits of Saudi Arabia and the UAE, as they will be expiring in 2024.

As stated before in other pieces, the situation of Egypt’s financials and budget is worrying. The very difficult discussions and negotiations with the IMF also are putting sometimes oil on the fire. To partly counter internal unrest and instability, president Sisi has also decided to put the presidential elections earlier than expected. Some say to counter IMF pressure, which is largely going to decide economic liberalization, IPOs, divestments and the position of the Egyptian Pound long-term. By first winning the elections, as the opposition is very weak, Sisi will be holding the powers to push all other measures through without fearing for his political life.

Figures known already, show that the UAE’s deposits at present are $10.7bn, split between $5.7bn in the long term and $5bn in the short term. Qatar has deposits of around $4bn, Saudi Arabia has $10.3bn, and Libya has $900m. In a move to increase confidence of international financial markets, the Egyptian Central Bank stated already that the net international reserves increased to $34.97bn at the end of September 2023. These discussions are still very rational, as financials can be assessed and solutions found. However, the main threat on the horizon, which is not discussed openly in Egypt or IMF/GCC, will be the impact and outcome of the ongoing war between Hamas and Israel. Currently the confrontation is mainly focused on Gaza and West Bank, but could easily spread regionally. The 1st phase of the ground offensive by the Israeli armed forces (IDF) has just started. Possible part-taking of Hezbollah, Iran and others needs to be taken into account. Regional instability however is not at all to the advantage of Egypt and its economic growth potential. If Arab countries are also going to be hit or pressured, the latter could also have a direct impact on the willingness of Riyadh and Abu Dhabi to proceed with financial injections into the Pharaonic economic system.