The impact of the Hamas atrocities and the resulting Israeli war on Gaza is already having a large impact on regional energy cooperation. As has been shown by the troubles hitting Egypt’s LNG exports, due to the closure of Israel’s offshore natural gas project Tamar, and the resulting instability in Lebanon, East Med’s energy future is under pressure.

At the same time, largely due to Turkish president Erdogan’s choice to back Hamas and the Palestinians, the possibility of an Israeli-Turkish offshore drilling program is being put on ice, maybe for good. Analysts already are also stating that the discussion between Israel and Turkey on the construction of an offshore natural gas pipeline between the two of them are out of question right now.

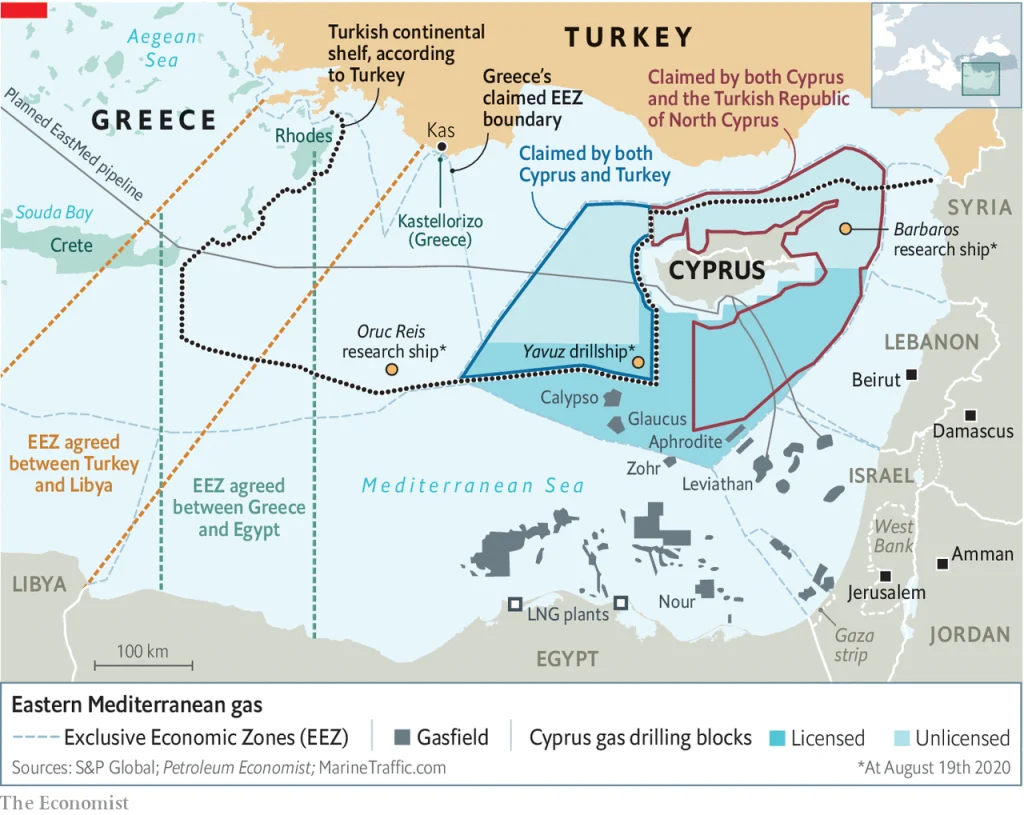

Even that Israel’s energy future will be hit, as Turkey is still a vast natural gas market of the future, it seems that Ankara will need to reconsider its own future too, as the economics will be much more debilitating for Erdogan’s government than currently is anticipated. As Israel, in close cooperation with Egypt and Cyprus, has already signed natural gas export agreements with Europe, backed up by bilateral agreements with several European countries, all including options to construct a direct offshore natural gas pipeline too, Turkey’s energy hub dream is in shatters. The only East Med agreement that Ankara currently can claim to have is a very disputable and economically irrelevant agreement with Libya. The latter will never see the light, as it needs to transit Greek, Cypriot, Israeli and Egyptian territorial waters, which all are out of reach for Erdogan. The claim that Turkey and Libya even share possible maritime borders is regarded to be a farce for sure.

The last weeks Erdogan has only succeeded to remove any real fundamentals still existing of a potential cooperation with Israel, and indirectly with Egypt or even more far-fetched Cyprus (as Ankara still occupies part of the island), by declaring Hamas not a terrorist organization. The latter statement also has ruffled a lot of feathers in Europe, which is also not supporting Turkey’s continuing bid to enter the European Union. By declaring or hinting even the option that the Turkish armed forces will engage in the war in Gaza is considered a real threat, even that a rational analysis shows that Turkey not going to be involved in the battle at all. As a NATO member, and still seeking EU membership, the country knows its limitations. Looking at the domestic situation, the Turkish economy is struggling, while the overall Turkish Armed Forces should not be considered as being a straightforward proponent of Erdoganisms. Turkey also is already involved in major other conflicts, especially with the PKK, YDP and others in Syria, Iraq and on its home-turf. Main issue however is that Turkey would be confronted by all other NATO members, especially the immense naval force buildup currently in the East Med.

The total picture at present painted by Erdogan and his backers is however dark enough to expect a total shutdown of any Turkish involvement offshore East Med very soon, if ever. The position taken by Erdogan, and his eternal wish to be in the spotlights, now has been materializing a full-scale backlash on all his East Med plans. For the Israelis, it makes energy cooperation choices again easier, as the Turkish option is off limits.

At the same time that Turkish-Israeli relations are shattered, especially on the diplomatic-political level, Ankara still seems to allow crude oil to flow to Israel. Until now Erdogan has not even tried or indicated any possible action against the continuation of the flow of crude oil and petrochemical imports via Turkish territory or the Dardanelles. The last days reports have shown that the Seaviolet, an oil tanker registered in Malta, has transported 1 million barrels of Azerbaijani crude from Turkey’s Mediterranean oil hub port of Ceyhan to Israel’s Eilat Port. Bloomberg also stated that around 40% of Israel’s annual oil consumption is met by crude that is piped to Ceyhan for onward shipping. Political reality and economics are sometimes different sides of the same coin it seems for Erdogan.

Looking at the Israeli offshore reserves, Europe will be still looking at all. Forced by the removal of Russian gas volumes due to sanctions, Brussels will not have any other choice if it wants to diversify its overall imports to address now fully the Israel-Egypt-Cyprus options available. Until now, Israel has around 750 billion cubic meters of offshore natural gas reserves. The potential could even be more if the last week’s awarded licenses will be successful.