By Cyril Widdershoven

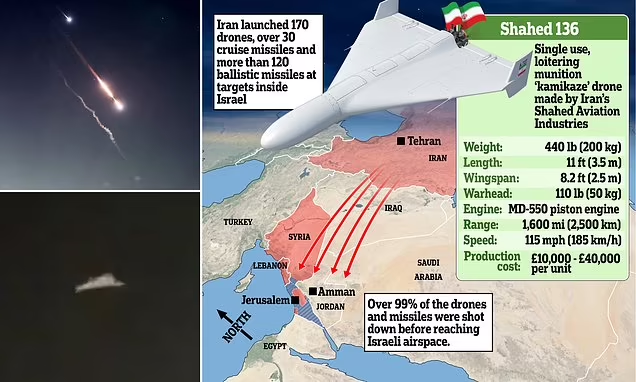

After Iran’s military attack on Israel, resulting in minimal damage, the Middle East is on edge. Since October 7, 2023, when Hamas massacred around 1400 Israelis and the military operation of Israel in Gaza, instability is back. Until now, the overall impact of the Israel-Hamas conflict, and the use of Iranian proxies in Yemen (Houthis), Lebanon (Hezbollah), and Iraq against Israel and Western interests, has been limited. The only real global repercussions of the ongoing war is the partial blockade of the Suez Canal – Red Sea maritime arena, which has increased maritime shipping costs and put pressure on supply chains. Since this weekend, the conflict has however entered into a new phase, as Iran, for the first time, has directly attacked Israel, sending hundreds of drones and ballistic missiles to hit the Jewish state. Due to a combined effort of not only Israel and the USA but also European partners and surprisingly enough major Arab states, such as Saudi Arabia and Jordan, 99% of all missiles and drones have been shot down before doing real harm.

Western media reporting however is downplaying the potential fall-out of the Iranian attack, as most experts are stating it has been a strategic but very limited Iranian military response to the so-called bombing of the Iranian diplomatic compound in Damascus by Israel. The latter however is wrong, as the Israeli bombing of the Iranian compound in Damascus was not an embassy or a consulate, but a headquarters of the Iranian IRGC forces and its proxies. At the same time, the analysis by some, in especially Europe, that the Iranian attack this weekend was only a show of force, not targeting to hit Israel but meant to be supporting Iran’s claim that it could destroy the Jewish state if wanted, is out of order. The total amount of rockets, missiles, and drones sent by Iran negates the view it was a media strategy for Iran’s internal politics. Simple military analysis is very clear, the amount of missiles and drones used by Iran, if not shot down, would have caused severe damage to Israeli infrastructure. The Iranian drones used in the attack are the same that caused havoc in Ukraine when used by Russian forces.

Until now the repercussions of the Iranian attack are unclear, but it seems to be set in stone that Israel will not stay silent. As indicated by the Israeli War Cabinet a response is being prepared, not indicating where Iranian interests or capabilities will be hit. However, looking at the historical facts, Israel will be taking a multi-sprung approach, in which not only Lebanon’s Shi’a terrorist organization Hezbollah, Syria’s military infrastructure, or IRGC military assets, will be targeted, but actions are to be expected inside of the Iranian heartland very soon. Without any doubt, Israeli security services are already inside Iran assessing high-profile targets, such as IRGC generals, regime leaders, and potentially Iran’s nuclear development centers or military bases. At the same time, Iran’s continuing support of Houthis in the Red Sea and last days IRGC hijacking of perceived Israeli-linked vessels could also lead to Israeli actions against Iranian maritime assets or navy.

The main question at present is not if there will be an Israeli response, but what will be the outcome or fall-out afterward. Potential Israeli strikes on Hezbollah or Syria have been almost a daily occurrence, but a direct strike on Iranian assets in Iran or in the Persian Gulf is still not done. If these however will happen, Iran could be pushing Hezbollah and Syria to react in full, opening up a 2nd and 3rd front for the Israeli military in days. How far Israel will be supported in case of a full-scale war with Iran and proxies by the USA and its Western allies is not clear. US President Biden’s responses at present are ambiguous, stating that US support for Israel is “ironclad”, but will this also mean using the full military force of the US and other Western military/navy in the region against Iran? Another major question mark is the position of so-called Arab allies of the West in this conflict. Already Qatar and Turkey have indicated that they will not allow US forces to use their bases to attack Iran in case of a war. This minimalizes not only the full scope of US options but also shows that Western interest in the Middle East or Arab support is not set in stone. Still, the current unexpected move by Jordan (60% Palestinian) and Saudi Arabia (officially not having diplomatic relations with Israel) to block and actively engage Iranian drones and missiles is showing a shift in attitude, to say the least. The UAE, still fully engaged with Bahrain, in Abraham’s Agreements with Israel, is a silent partner of the West.

The next weeks could be decisive for the future of the MENA region, as the existing conflict between Israel and Iran seems to have heated up beyond a possible de-escalation situation. No Israeli leader will be able to survive a de-escalation strategy at present. For Israeli PM Netanyahu and his War Cabinet it now only needs to be a measured approach, not risking renewed Western support.

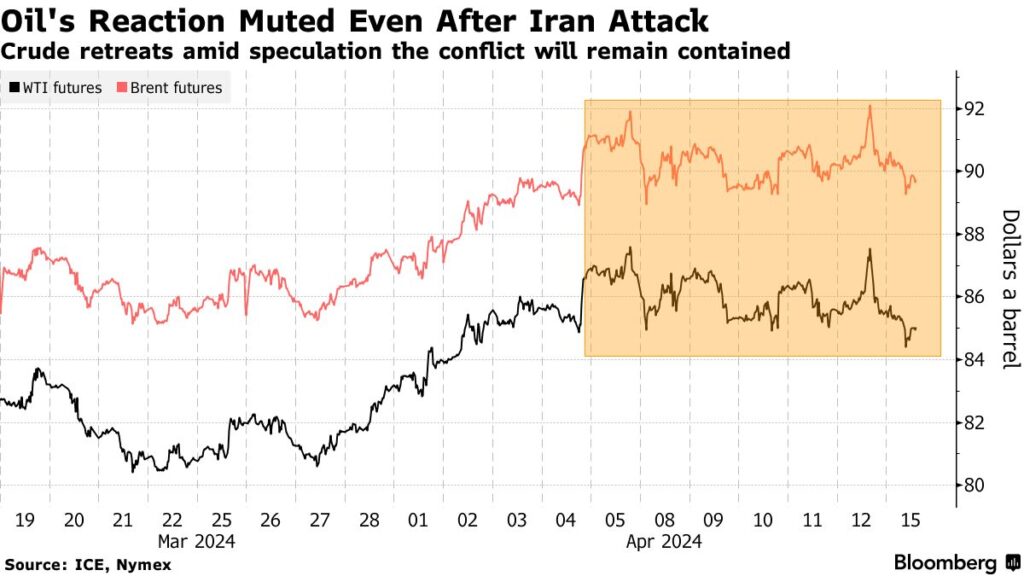

Oil and gas markets however seem to be oblivious to all. After the last days of a clear Bull Market, stoked by fear about an Iranian attack on Israel, New York and London-based energy analysts seem to believe their assessments more than listening to military analysts. Commodity traders seem to be relieved about the limited impact of the Iranian drone and missile attack, starting to support the fairy tale that Iran didn’t want to start a real full-scale war, and that fears about instability in the region are overblown. Leading US and UK newspapers are all indicating that the Iranian attacks were not targeting Israeli energy infrastructure (why should they?) and that most targets were not even linked to the Red Sea arena.

At a time when oil markets are confronted by a supply crunch, mainly due to OPEC+ continuing its production cuts, while demand is still up and showing only signs of strong future demand, the current lack of realism in the heads of traders is amazing. Yes, we have seen a strong increase in crude oil prices in 2024, up from around $70 per barrel to now hovering around $90 per barrel, but this only was based on demand-supply fundamentals, as geopolitical risk premiums are still not very high. It seems that traders only react to non-stories such as IRGC threats about the closure of Hormuz or a potential new wave of Houthi rockets in the Red Sea. The underlying threat of a real regional war, maybe not even focusing on the Arabian/Persian Gulf arena or Strait of Hormuz, but in the heartland of Iran while opening up a confrontation between Hezbollah and Israel, seems not to be on their mind.

The ongoing creeping confrontation between Israel and Iran is far from over, it seems it is just a preparatory phase leading to a real regional war. Iran’s power politics are at play, while the fundamentalist extremist leadership backed by its IRGC forces understands the future of the Khomeini revolution is at stake. Inside of Iran forces are building up to destabilize the country, targeting the toppling of the Khamenei regime. At the same time, Iran’s proxies in Iraq, Syria, and Lebanon are calling for action, not only against Israel but also against US-Western-backed forces. We are looking at growing conflict in Lebanon already where Hezbollah is targeting Lebanese Christian leaders, stoking up the fear of a new civil war. Iraq’s Shi’a militias are preparing for a full-scale take-over of the country, removing Kurdish powers in the north, while removing US forces overall.

The region is not only a powder keg, but it is already burning. At the same time, geopolitical power play is heating up also, as Russia and China are still behind Iran and its proxies. For Moscow, the current risk premiums are very high. The media and political focus of Western leaders at present seems to be allowing Moscow to reap the rewards in full, it is selling its crudes on global markets way above the Western-sanctioned linked price caps. Moscow also looks at the regional confrontation with a smile, as it is removing Western attention from the ongoing Russian military onslaught in Ukraine. China is playing a very dark role, as it is not only supplying Russia with military hardware to continue the Ukraine war, but it also allows Iran to continue its destructive path in the region.

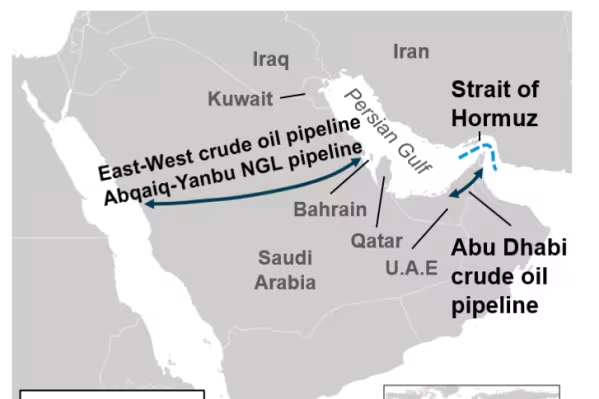

Commodity traders should not be assessing the situation as just a minor geopolitical or military issue, not having a potentially disastrous impact on oil and gas markets. Before 2020 any disturbance in the Middle East would have spiked crude oil and gas prices, at present it only seems to be a side-show without any impact. Most analysis currently is again looking at fundamentals such as OPEC’s spare production capacity or the still growing US oil and gas production, both seen as the ultimate guarantee against shortages in the market. Some even stated that a full-scale regional conflict would not affect markets, as Saudi Arabia and others hold enough spare production capacity to counter all. Paraphrasing former President Bush I would say “It is geography stupid!” A regional confrontation with Iran will be hitting Saudi’s crude oil export and production potential very hard. At the same time, Qatar’s LNG or Abu Dhabi’s oil and gas exports will also be constrained or blocked. It doesn’t need to be due to a Gulf or Hormuz blockade, drones or missiles can do the job too on onshore facilities. Just remember the cyber attacks on Aramco’s Abqaiq or Houthi/Iranian missiles in the last years.

For Iran, a blockade of Hormuz is suicide, as it is the only option to export oil and gas to markets. This however is also the case for all the others, as Saudi or UAE’s non-Gulf-based pipelines are not sufficient or will be targets in a conflict. Traders also should realize that realism or conventional wisdom will not be in the minds of policymakers, military strategists, or extremists if the Israel-Iran confrontation blows up. At that moment there will be a no-prisoners approach on all sides. The latter will be for sure not in the minds of all the extremist groups in Iraq, Syria, Yemen, or Lebanon, an Iranian call on them will be imminent and much more destabilizing than currently is being assessed.

In short, commodity traders should be wary of presuming that the current situation is going to cool down. No indicators are showing any change in attitude on all sides. Looking at global oil and gas markets fundamentals we are already heading towards a normal supply crunch if OPEC+ doesn’t open up the valves very soon. A major disruption of any supplier or maritime supply route will cause havoc. The current statements by traders should be reassessed, as their optimism could backfire and cause a lot of pain.