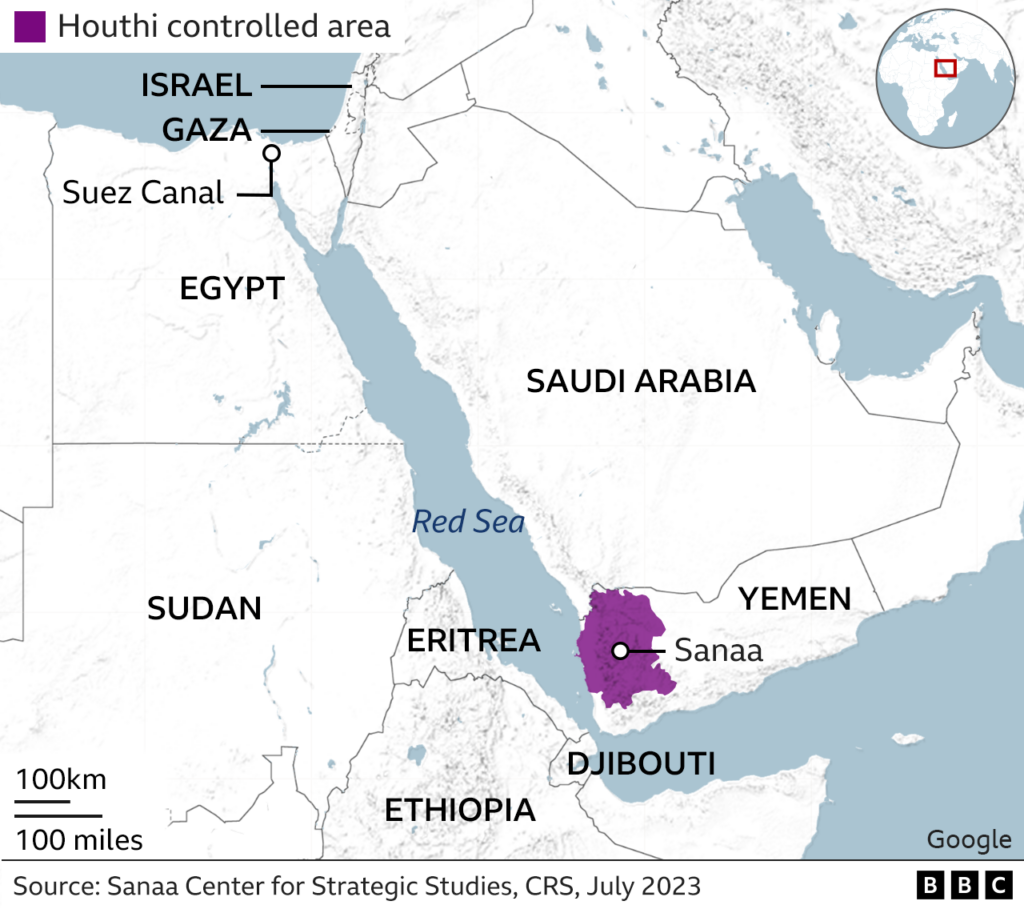

The expected US-UK, supported by several allies, airstrikes against Yemen’s Houthi rebels has raised escalation levels in the Middle East overall. Even that the clear tactical airstrikes have shown the resolve of Western powers to quell the ongoing Houthi threats in the Red Sea, one of the world’s main maritime trade routes, the outcome of all is still unclear. The overall damage done to the Houthi military infrastructure is not yet known, even that radar sites and missile launchers of the rebel force have been hit with rockets and cruise missiles. All eyes will be on the fall-out of last night’s actions as the Houthis are a proxy of Iran, closely connected to not only Hamas (Gaza) but also to Lebanon’s main military power the Shi’a militia Hezbollah. A possible answer is to be expected, which could be multi-faced, including Lebanon-Yemen, Iran and Iraq.

As expected oil and gas markets have reacted to the news, as global benchmark Brent increased by around 3.5% to $80 per barrel in London. Volatility is back in the market, this time with a bang if all signs will be going on red very soon. International shipping sites also have stated that most maritime companies have indicated to be watching all while diverting even more vessels from the Bab Al Mandab-Red Sea-Suez Canal route.

In a statement made by U.S. Air Force Lt. Gen. Alex Grynkewich, U.S. Air Forces Central and Combined Forces Air Component Commander, the latter stated the last hours that “at the direction of U.S. Central Command, U.S. Air Forces Central, CENTCOM’s Joint & Combined Air Component Command, executed deliberate strikes on over 60 targets at 16 Iranian-backed Houthi militant locations, including command and control nodes, munitions depots, launching systems, production facilities, and air defense radar systems.

Over 100 precision-guided munitions of various types were used in the strikes. These strikes were comprised of coalition air and maritime strike and support assets from across the region, including U.S. Naval Forces Central Command aircraft and Tomahawk Land Attack Missiles launched from surface and sub-surface platforms”.

As has become clear since weeks, the Yemeni Houthi rebels, fully backed by Iran, would not comply to any requests or threats to end their terrorist actions in the Red Sea arena. After even several major confrontations in the Red Sea and Bab Al Mandab between Western Naval forces and Houthi forces, no real change in the behavior of the Yemeni rebels was seen. As stated by US president Biden, “these strikes are in direct response to unprecedented Houthi attacks against international maritime vessels in the Red Sea — including the use of anti-ship ballistic missiles for the first time in history”.

Military experts agree that some of the Houthi military capabilities have been degraded, but a full-scale removal of maritime threats is not at all in place. At the same time, Houthis and its allies in the region are expected to counteract very soon. As all eyes are on the Red Sea arena, it looks very possible that Iran’s other proxies or even Iran’s IRGC forces will act on Western forces or interests the coming days. Main possible action theatres the coming days are in the Lebanese-North Israel theatre or Iraq, where already an ongoing military escalation is ongoing between Iraqi-Iranian proxies and militias and US military forces. Iran is still not willing to engage in a direct confrontation with the West, especially with the US, UK or Israel, but the Western military action against the Houthis will not be brushed aside by Iran’s extremist-fundamentalist IRGC leaders.

The risk of a regional war is creeping closer, especially when taking account the ongoing escalation between the Israeli armed forces in the north of the country and the Hezbollah in Lebanon. The potential of a direct counter-move by Hezbollah at present is high, as Western naval forces will be on full alert in the Red Sea, with a main focus on Houthis and potential Iranian IRGC and proxies forces around. At the same time, taking into account the seizure of a US vessel the last days in the Gulf of Oman by Iranian forces, the potential of a multi-theatre confrontation is not unthinkable, keeping US and Western navies in the Arabian-Persian Gulf occupied already. The fact that the latest move against the Houthis was done by a coalition of US-UK, supported by Australia, Bahrain, Canada, and the Netherlands, puts also Arab countries at risk.

Since November 2023 Houthis have launched over 27 attacks on commercial ships and US – UK naval vessels in the Red Sea arena. The continuing Houthi attacks have not only constrained global maritime trade, but also is putting Arab countries at risk, such as Egypt and Saudi Arabia. For the latter, a blockade or security threats to the Red Sea are still minimal but will have a potential negative fall-out on Saudi’s logistic-port development and investment plans. At the same time, part of Saudi crude oil and petrochemical product exports are linked to its outlets on the Red Sea, not only because its less far from European markets but also to quell a potential closure by Iran of the Strait of Hormuz.

Egypt, the largest and military most capable Arab state, is also being threatened by the Houthi-Iranian moves. Threats to the Red Sea and Bab Al Mandab directly affect the Egyptian economy, which is partly reliant on its geographical position but also on the revenues of the Suez Canal, the main artery between the Mediterranean (Europe) and the Red Sea. The continuing conflict in Gaza and the direct kinetic threats of the Houthis has already resulted in high financial costs for the already struggling Egyptian economy. Suez Canal Authority (SCA)’s head Osama Rabie stated on Thursday that US dollar revenues from Egypt’s Suez Canal are down 40% from the beginning of the year compared to 2023. He reiterated that the latter is largely caused by attacks on ships by Yemen’s Houthis.

The SCA reported also that ship traffic was down 30% in the period between Jan. 1 and Jan. 11 compared to a year prior, as only 544 vessels have passed until now, in comparison to 777 in the same period of 2023. A prolonged period of stagnation of traffic and revenues of the SCA will be causing even more havoc in the Egyptian economy, putting more and more pressure on the El Sisi regime. Further instability could force Egypt, and its allies, especially Saudi Arabia and the UAE, to become also a part of the ongoing confrontation with Iran and its proxies. Until now, all Arab states have stayed very quiet with regards to the Hamas-Israel-Hezbollah confrontation, but economic and security could now be pushing direct Arab engagement very soon. Even that there is a thaw in Arab-Iranian relations, at least on the diplomatic-media front, threats to security and economy will put the latter on ice. Iran is still not seen as a reliable partner, while Hamas-Hezbollah-Houthis are not on the invitation list of any Arab regime, except Qatar.

Overall risks are increasing, putting higher levels of oil price spikes at play. With oil and gas demand still going strong, expected to reach record levels in 2024-2025, regional conflict or a full-scale West-Iran war, are not bearish indicators. At the same time, current constraints in maritime trade also will be pushing prices up, not only of products or vessels, but also energy, as demand for shipping fuels will increase too.